Understand The Key Trends Shaping This Market

Download Free SampleBrazil Ice Cream Market Overview: Market Size & Forecast (2026–2032)

What is the expected growth trajectory and market size of the Brazil Ice Cream Industry during 2026-2032?

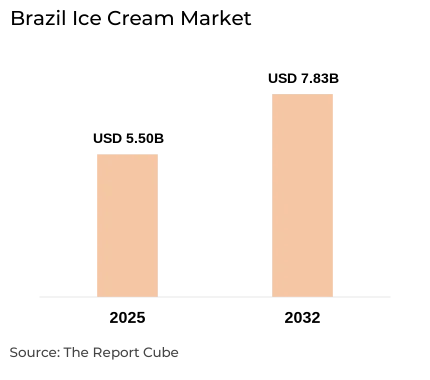

The Brazil Ice Cream Market is projected to grow at a CAGR exceeding 5.18% during 2026-32, supported by the country’s warm climate, strong cultural affinity for sweets, and broad retail accessibility. Additionally, the market size was valued at nearly USD 5.5 billion in 2025 and is projected to reach nearly USD 7.83 billion by 2032.

Market Insights & Analysis

The Brazil Ice Cream Market demonstrates robust growth prospects, reinforced by an expanding middle-class population, rising disposable income, and dynamic consumer preferences that favor premium, artisanal, and health-focused products. Moreover, a significant driver shaping the Ice Cream Market trends in Brazil is the shift toward healthier options, as Brazilian consumers, especially younger cohorts, increasingly seek lower-calorie, sugar-free, and plant-based alternatives, owing to heightened awareness of dietary impacts and widespread lactose intolerance. As a result, manufacturers are innovating with vegan options, natural sweeteners, and “clean label” formulations to capture diverse consumer segments.

However, health concerns over sugar & fat content present challenges for traditional formulations, pushing ice cream brands to reformulate & invest in new product development to retain the Brazil Ice Cream Market relevance. Nevertheless, the Brazil Ice Cream Industry outlook remains positive as key ice cream players leverage these developments, invest in online channels, and cater to evolving preferences, positioning the country as a prominent regional & global Ice Cream Market leader during the forthcoming years.

Brazil Ice Cream Industry: Recent News & Developments

- 2024: Duas Rodas, through its brands Specialitá & Selecta, launched 18 novel ice cream ingredients at Fispal Sorvetes in São Paulo. Further, aligned with evolving global consumer trends, these launches emphasize innovative flavors & textures designed to elevate indulgence in frozen desserts.

Brazil Ice Cream Market Dynamics

Which key factor acts as a positive catalyst for the growth of the Ice Cream Market in Brazil?

- Rising Demand for Health-Conscious & Plant-Based Ice Creams: The significant prevalence of lactose intolerance and a wider health-conscious movement have triggered robust demand for vegan, low-sugar, and clean-label ice creams across the country. According to the recent data from the GEDIIB registry, the high prevalence of lactose intolerance among Brazilians (more than 63%) has driven rising consumer demand for lactose-free and vegan products, reflecting an important public health & dietary trend influencing market behaviors.

This confirms a strong correlation between health awareness, genetic predisposition, and evolving consumer preferences shaping the Brazil Ice Cream Market. Therefore, producers are responding with plant-based recipes & options, avoiding artificial additives, ensuring these health-driven products have moved from niche to mainstream.

What are the key obstacles impacting the growth of the Brazil Ice Cream Market?

- Rising Cost Pressures from Natural Ingredients & Sustainable Packaging: The adoption of natural ingredients and sustainable packaging has amplified cost pressures. Also, escalating prices for key inputs, together with the expense of organic certification and eco-friendly logistics, are straining margins in a competitive environment that demands both affordability and innovation. This is expected to limit the growth and expansion of the Brazil Ice Cream Industry.

How are emerging opportunities expected to reshape the Brazil Ice Cream Market in the upcoming years?

- Rising Inclination Towards Quick Commerce in Brazil: The rapid expansion of quick commerce platforms such as iFood, Rappi, Mercado Livre, Americanas, and Magazine Luiza in Brazil, delivering groceries and frozen desserts within minutes, has become a crucial enabler for meeting robust ice cream demand. This channel caters especially to urban, tech-savvy consumers who prioritize instant gratification & convenience.

Moreover, the availability and growing inclination toward app-based ultra-fast delivery sustain the frequent and on-demand consumption of ice cream, extending market reach beyond traditional retail. This trend is particularly significant in metropolitan areas like São Paulo and Rio de Janeiro, where quick commerce growth rates are among the highest in Latin America. Thereby, creating lucrative opportunities for ice cream penetration in both urban and emerging consumer pockets.

What key market trends are currently influencing the outlook for the Brazil Ice Cream Market?

- Customization & Functional Innovation Driving Consumer Demand: Consumers are moving beyond tradition toward personalized, functional options such as probiotic-rich, high-protein, or superfood-infused ice creams. Brands deploying AI-driven flavor development & smart packaging can meet the rising demand for novelty and wellness together. This evolving trend further facilitates the exponential growth and adoption of ice creams in Brazil.

Brazil Ice Cream Industry Segmentation Analysis

- Flavor: Vanilla, Chocolate, Fruit, and Others

- Product: Cup, Stick, Cone, Brick, Tub, and Others

Flavor:

The Fruit Flavor sub-segment is projected to lead market growth in Brazil during 2026-2032. Its alignment with health trends, local flavor preferences, and the demand for refreshing natural alternatives makes it the fastest-growing flavor category. While vanilla and chocolate remain dominant by volume, fruit flavors are expected to capture increasing consumer interest and drive market expansion, especially in premium and artisanal segments.

Product:

The Tubs and Cups sub-segment is projected to lead the Brazil Ice Cream Market in the coming years. These packaging formats offer versatility for both individual consumption & family use, making them highly popular for in-home consumption. Moreover, this sub-segment is expected to maintain robust growth due to convenience, affordability, and the increasing trend of at-home ice cream consumption.

What Does Our Brazil Ice Cream Market Research Study Entail?

- The Brazil Ice Cream Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Brazil Ice Cream Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Brazil Ice Cream Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Flavor

- Vanilla

- Chocolate

- Fruit

- Others

- Market Share, By Product

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

- Market Share, By Type

- Dairy and Water-based

- Vegan

- Market Share, By Distribution Channel

- Off-Trade

- On-Trade

- Market Share, By Region

- São Paulo

- Minas Gerais

- Rio de Janeiro

- Bahia

- Rio Grande do Sul

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Brazil Vanilla Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Brazil Chocolate Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Brazil Fruit Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Brazil Others Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Unilever Plc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nestlé SA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sorvetes Jundiá Indústria E Comércio Ltda.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sorveteria Creme Mel S.A.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Chiquinho Ice Cream

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Industrial e Comercial MARVI LTDA.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Unilever Plc

- Contact Us & Disclaimer

List of Figure

-

Figure 1 — Study scope and structure (flowchart)

-

Figure 2 — Objective of the study (key questions & deliverables)

-

Figure 3 — Product definition and product taxonomy

-

Figure 4 — Market segmentation framework (by flavor, product, type, channel, region)

-

Figure 5 — Study variables and definitions

-

Figure 6 — Research methodology overview (secondary + primary)

-

Figure 7 — Secondary data sources and data map

-

Figure 8 — Companies interviewed (list and company types)

-

Figure 9 — Primary data collection design (questionnaire breakdown)

-

Figure 10 — Breakdown of primary interviews (respondent types and counts)

-

Figure 11 — Executive summary: market snapshot (infographic with key metrics)

-

Figure 12 — Market dynamics framework

-

Figure 13 — Key drivers of growth (visualized)

-

Figure 14 — Key market challenges (visualized)

-

Figure 15 — Opportunity assessment matrix (impact vs. feasibility)

-

Figure 16 — Recent trends and developments timeline

-

Figure 17 — Policy & regulatory landscape: summary map (major regulations affecting ice cream)

-

Figure 18 — Brazil Ice Cream Market: historical & forecast market size (2020–2032, USD bn)

-

Figure 19 — Brazil Ice Cream Market: annual growth rate (CAGR) 2020–2032

-

Figure 20 — Market share by flavor (pie chart)

-

Figure 21 — Flavor share trend (Vanilla / Chocolate / Fruit / Others) — 2020–2032

-

Figure 22 — Market share by product (Cup / Stick / Cone / Brick / Tub / Others)

-

Figure 23 — Product share trend (2019–2030 forecast)

-

Figure 24 — Market share by type (Dairy, Water-based, Vegan)

-

Figure 25 — Type share trend (2019–2030 forecast)

-

Figure 26 — Market share by distribution channel (Off-trade vs On-trade)

-

Figure 27 — Channel share trend (2019–2030 forecast)

-

Figure 28 — Market share by region (São Paulo, Minas Gerais, Rio de Janeiro, Bahia, Rio Grande do Sul)

-

Figure 29 — Regional market map of Brazil (regional revenue heatmap)

-

Figure 30 — Competitive landscape overview (market structure and positioning)

-

Figure 31 — Competition characteristics (barrier, product breadth, price tier)

-

Figure 32 — Revenue shares of key competitors (stacked bar / pie)

-

Figure 33 — Brazil Vanilla Ice Cream Market: value (2020–2032, USD million)

-

Figure 34 — Vanilla by product — market size & forecast (2019–2030, USD million)

-

Figure 35 — Vanilla by type — market size & forecast (2019–2030, USD million)

-

Figure 36 — Vanilla by distribution channel — market size & forecast (2019–2030, USD million)

-

Figure 37 — Brazil Chocolate Ice Cream Market: value (2020–2032, USD million)

-

Figure 38 — Chocolate by product — market size & forecast (2019–2030, USD million)

-

Figure 39 — Chocolate by type — market size & forecast (2019–2030, USD million)

-

Figure 40 — Chocolate by distribution channel — market size & forecast (2019–2030, USD million)

-

Figure 41 — Brazil Fruit Ice Cream Market: value (2020–2032, USD million)

-

Figure 42 — Fruit by product — market size & forecast (2019–2030, USD million)

-

Figure 43 — Fruit by type — market size & forecast (2019–2030, USD million)

-

Figure 44 — Fruit by distribution channel — market size & forecast (2019–2030, USD million)

-

Figure 45 — Brazil Others Ice Cream Market: value (2020–2032, USD million)

-

Figure 46 — Others by product — market size & forecast (2019–2030, USD million)

-

Figure 47 — Others by type — market size & forecast (2019–2030, USD million)

-

Figure 48 — Others by distribution channel — market size & forecast (2019–2030, USD million)

-

Figure 49 — Competitive outlook: company market shares (top players)

-

Figure 50 — Unilever Plc — company snapshot infographic (revenue, market segments, ICE CREAM share)

-

Figure 51 — Unilever — strategic alliances & timeline of recent developments

-

Figure 52 — Nestlé SA — company snapshot (revenue, segments, ice cream footprint)

-

Figure 53 — Nestlé — strategic alliances & recent developments timeline

-

Figure 54 — Sorvetes Jundiá — company profile snapshot

-

Figure 55 — Sorvetes Jundiá — strategic moves & recent developments

-

Figure 56 — Sorveteria Creme Mel S.A. — company snapshot

-

Figure 57 — Chiquinho Ice Cream — company snapshot & growth highlights

-

Figure 58 — Industrial e Comercial MARVI LTDA. — company snapshot

-

Figure 59 — Competitive benchmarking table (product range, price tier, distribution reach)

-

Figure 60 — SWOT summary for selected companies (visual matrix)

-

Figure 61 — Contact & disclaimer (report metadata panel)

List of Table

-

Table 1 — Study variables and definitions

-

Table 2 — Companies interviewed (by type, size, and segment)

-

Table 3 — Breakdown of primary interviews (respondent profile)

-

Table 4 — Brazil Ice Cream Market size by value, 2020–2032 (USD billion)

-

Table 5 — Market share by flavor, 2020–2032 (%)

-

Table 6 — Market share by product type, 2020–2032 (%)

-

Table 7 — Market share by type (Dairy, Water-based, Vegan), 2020–2032 (%)

-

Table 8 — Market share by distribution channel (Off-trade, On-trade), 2020–2032 (%)

-

Table 9 — Market share by region (São Paulo, Minas Gerais, Rio de Janeiro, Bahia, Rio Grande do Sul), 2020–2032 (%)

-

Table 10 — Revenue shares of key competitors, 2020–2032 (%)

-

Table 11 — Brazil Vanilla Ice Cream Market size, 2020–2032 (USD million)

-

Table 12 — Vanilla market by product, 2019–2030 (USD million)

-

Table 13 — Vanilla market by type, 2019–2030 (USD million)

-

Table 14 — Vanilla market by distribution channel, 2019–2030 (USD million)

-

Table 15 — Brazil Chocolate Ice Cream Market size, 2020–2032 (USD million)

-

Table 16 — Chocolate market by product, 2019–2030 (USD million)

-

Table 17 — Chocolate market by type, 2019–2030 (USD million)

-

Table 18 — Chocolate market by distribution channel, 2019–2030 (USD million)

-

Table 19 — Brazil Fruit Ice Cream Market size, 2020–2032 (USD million)

-

Table 20 — Fruit market by product, 2019–2030 (USD million)

-

Table 21 — Fruit market by type, 2019–2030 (USD million)

-

Table 22 — Fruit market by distribution channel, 2019–2030 (USD million)

-

Table 23 — Brazil Others Ice Cream Market size, 2020–2032 (USD million)

-

Table 24 — Others market by product, 2019–2030 (USD million)

-

Table 25 — Others market by type, 2019–2030 (USD million)

-

Table 26 — Others market by distribution channel, 2019–2030 (USD million)

-

Table 27 — Company profiles: business segment overview of leading players

-

Table 28 — Strategic alliances and partnerships (selected companies)

-

Table 29 — Recent developments of leading players (M&A, product launches, expansions)

-

Table 30 — Competitive benchmarking matrix (product range, price tier, distribution reach)

-

Table 31 — SWOT summary of selected companies

Top Key Players & Market Share Outlook

- Unilever Plc

- Nestlé SA

- Sorvetes Jundiá Indústria E Comércio Ltda.

- Sorveteria Creme Mel S.A.

- Chiquinho Ice Cream

- Industrial e Comercial MARVI LTDA.

- Others

Frequently Asked Questions