Understand The Key Trends Shaping This Market

Download Free SampleIndia Mango Candy Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the India Mango Candy Market?

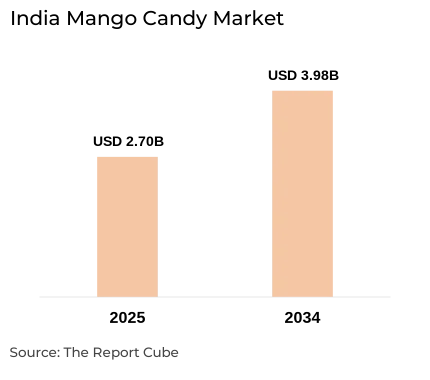

The India Mango Candy Market is anticipated to register a CAGR of around 4.4% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.70 billion in 2025 and is projected to reach almost USD 3.98 billion by 2034.

Market Analysis & Insights

The India Mango Candy Market is instigated by solid customer affinity for mango tastes, growing confectionery distribution channels, and flavor innovation across both mass & premium tiers. Mango candies made from sugar-boiled confectionery & hard-boiled candy SKUs to jellies & chews containing Kaccha Aam flavour or ripe Alphonso notes benefit from omni-channel reach (kirana, modern trade, and e-commerce) & upscaling impulse purchases.

Furthermore, to scale promotions, leading market companies, including Parle: Parle Mango Bite sales, DS Group: DS Group confectionary, Perfetti Van Melle, etc., practice regional sourcing & national distribution of processed mango goods across the landscape of India. Additionally, the tangy candy demand & the sweet and sour candy trend in the mass market are emphasized by DS Group's expansion of Pulse candies & other related items. Also, market limitations like shelf stability, seasonality, and the source of natural concentrates, as well as the opportunities like premiumization, sugar-reduced choices, and export potential are all the market dynamics altering the growth graph & India Mango Candy Market demand.

Moreover, government of the country is focussing on F&B grade standards & cold-chain support for fruit processors ultimately contributing in enhancing the ingredient quality for candies. Also, increasing disposable income, innovative candy flavors, and enhanced route-to-market would support in creating a positive India Mango Candy Market outlook through 2034.

What is the Impact of AI in the India Mango Candy Market?

AI is progressively being favored across the India Mango Candy Market as it aids in improving product development, supply chain optimization, and customer engagement. Also, it assists in piloting cut waste, minimize time-to-shelf for innovative candy flavors, and enabling directed digital promotions, solidifying distribution efficiency in confectionery distribution channels.

A few projects undertaken by companies in terms of AI, that benefits India Mango Candy Market are:

- In 2025, Parle’s extended collaboration on AI/cloud & analytics (with IBM) is enhancing forecast accuracy & Parle Mango Bite sales planning, personalize marketing campaigns, and progress consumer retention.

- DS Group, in 2025 has applied AI-driven demand forecasting to optimize inventory & minimize waste.

India Mango Candy Market Dynamics

What driving factor acts as a positive influencer for the India Mango Candy Market?

- Expanding Demand Instigated by Flavor & Cultural Connection: The factors driving the India Mango Candy Market's growth is the rising customer preference for regionally ingrained authentic Indian flavors, like aam panna & kaccha aam. Further, owing to this demand, market companies such as DS Group confectionary have taken over the hard-boiled candy business. Also, market expansion is also instigated by the increasing demand for tangy candies and the tendency toward sweet and sour candies, which are bolstered by the expansion & confectionery distribution networks in both urban & rural India. Moreover, along with innovation in market, industry data illustrates that mounting volume growth linked with these culturally significant flavors would aid in enhancing the market size.

What are the challenges that affect the India Mango Candy Market?

- Encounters Related to Supply Chain Amid Raw Material Sourcing: The fluctuating cost & availability of processed mango products in India as a result of agricultural supply disruptions & climate changeability is a key concern for the country's food & beverage industry. These aspects influence the price variation of raw materials, which affects the profitability & expenses of manufacturing candies & raises issues about preserving constant quality. Moreover, market players that specialize in sugar-boiled confections, like Parle Products, need to carefully manage these supply chain challenges in order to continue progressing in Parle Mango Bite sales & their position as one of India's leading mango candy brands.

How are the future opportunities transforming the market during 2026-34?

- Flavor Diversification to Create Innovative Prospects: Creating novel candy flavors that go beyond classic mango overtones to content shifting customer tastes represents an unmapped opportunity. Across the India Mango Candy Market, combining traditional flavors with contemporary palates promotes product line developments. Further, as demonstrated by the consumption statistics of mango candy in India by well-known companies such as DS Group & Parle, such innovation can upscale demand by improving brand equity & reaching younger audiences. Also, creators might now predict new flavor trends across the Indian confectionery sector due to advances in AI-driven market analytics.

What market trends are affecting the India Mango Candy Market Outlook?

- Digitization, Technology Adoption & Sustainability Trend to Shape the Market: The India Confectionery Market is transforming owing to the incorporation of AI technologies into all aspects of operations, from production to customized marketing. Within current confectionery distribution systems, AI enhances customer targeting & distribution efficiency. Moreover, sustainability efforts that integrate eco-friendly packaging & reduces sugar content complement increasing health concern & would impact the India Mango Candy Market going forward. Further, these advances promote long-term market growth & enhance consumer confidence in top-selling mango candy brands across India.

How is the India Mango Candy Market Defined as per Segments?

The India Mango Candy Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Type of Candy: Hard-Boiled Candies, Pastilles, Gums, Jellies & Chews, Toffees, Lollipops, Twist & Stick Candy, Others

- Demographic: Kids, Teenagers & Young Adults, Adults.

By Type of Candy:

The Hard-boiled Candy segment leads with over 19% India Mango Candy Market share.

The traditional Kaccha Aam flavor, wide-ranging distribution through strong confectionery distribution networks, and sturdy demand instigated by the deeply rooted cultural habit of sweet & sour candies are the primary factors contributing to this segment. Also, the sector is a key contributor to the expansion of the India Mango Candy Market & the foundation of the segment owing to its shelf durability & nostalgic appeal.

By Demographic:

The biggest customer base consists of Kids, that seizes about 60% of total mango candy consumption. Also, the segment is foreseen to flourish in the forecast years as well.

Brands such as DS Group confectionary & Parle Products are supported by their liking for sweet & tangy flavors, including aam panna, with Parle Mango Bite sales witnessing strong development. Also, according to India's mango candy consumption statistics, adults make up nearly 10% & are driven by health concerns & nostalgia, while teenagers & young individuals make up about 30% & are drawn to new candy tastes that are riding the wave of increasing desire for acidic candies.

India Mango Candy Market: What Recent Innovations Are Affecting the Industry?

- 2025: DS Group introduced a novel line of mango candy with improved packaging & enhanced flavor profiles, concentrating on health-conscious customers.

- 2025: Parle Products launched a sugar-free mango candy variant, leveraging natural sweeteners & innovative flavors to cater to health-conscious shoppers.

What are the Key Highlights of the India Mango Candy Market (2026–34)?

- The India Mango Candy Market is projected to record CAGR of 4.4% by 2026-2034, reaching around USD 3.98 billion by 2034.

- Under the type of candy, the hard-boiled candies uphold about 19% market share, owing to rising preference for flavors like Kaccha Aam flavor.

- Under flavor profile, raw mango flavor, commands about 26% share, favored for authentic tangy taste in mango candies.

- Under demographics, kids segment, grabs the largest consumer share, accounting for nearly 60% of the India Mango Candy Market share.

- Under distribution channel, Offline Convenience Stores governs with nearly 45% market share, followed by E-Commerce & Online Platforms, which is expanding swiftly capturing about 15% market share.

- AI adoption is altering supply chain management & customer engagement, fueling efficacy & innovation.

- Leading market brands such as DS Group, Parle Products, and Perfetti Van Melle India are transforming the industry with ground-breaking product launches & digital marketing strategies.

How does the Future Outlook of the India Mango Candy Market (2034) Appear?

- Sustained Growth: The India Mango Candy Market is destined to expand at a CAGR of about 4.4% during 2026-34, further gaining a market value of nearly USD 3.98 billion by 2034.

- Technological Upgrade: AI & digitization would improve confectionery distribution channels, motivating innovation in the hard-boiled candy segment with pioneering candy flavors.

- Future Opportunities: Booming demand for tangy candies, healthy trends, and an expanding online platform would assist in enhancing the India Mango Candy Market sales.

Through 2034, AI acceptance & cultural relevance would cement the future of Mango Candy Market in India, generating sustained growth & innovation as reported in the market research report.

What Does Our India Mango Candy Market Research Study Entail?

- The India Mango Candy Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The India Mango Candy Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variable

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- India Mango Candy Market Overview (2020-2034)

- Market Size, By Value (in USD Billion)

- Market Share, By Service Type

- Market Share, By Type of Candy

- Hard-Boiled Candies

- Pastilles

- Gums

- Jellies & Chews

- Toffees

- Lollipops

- Twist & Stick Candy

- Others

- Market Share, By Demographic

- Kids

- Teenagers & Young Adults

- Adults

- Market Share, By Flavor Profile

- Raw Mango (Kachha Aam) Flavor

- Sweet Ripe Mango Flavor

- Spicy and Tangy Mix

- Artificial Mango Flavor

- Natural Mango Flavor

- Market Share, By Distribution Channel

- Conventional Stores

- Convenience Stores and Retail Outlets

- Kiosks and Standalone Stores

- Online Platforms

- Market Share, By Competitors

- Revenue Shares

- Competition Characteristics

- India Mango Candy Market Overview, 2026-2034 (Forecast Year Tables)

- By Value (in USD Billion)

- By Service Type

- By Type of Candy

- By Demographic

- By Flavor Profile

- By Distribution Channel

- Competitive Outlook (Company Profiles - Partial List)

- DS Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Parle Products

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Haldiram

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Perfetti Van Melle India

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Shadani Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bakewell Biscuits Pvt. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ravindra Foods Pvt. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- J V Candy Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mahabaleshwar Hill Agri Pvt. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- DS Group

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Objective of the Study

Figure 1.2: Product Definition – Mango Candy Types

Figure 1.3: Market Segmentation Overview

Figure 1.4: Study Variables

Figure 2.1: Research Methodology Flowchart

Figure 2.2: Secondary Data Sources

Figure 2.3: Companies Interviewed for the Study

Figure 2.4: Primary Data Collection Process

Figure 2.5: Breakdown of Primary Interviews by Stakeholder Type

Figure 3.1: Executive Summary – Market Snapshot

Figure 4.1: Key Drivers of India Mango Candy Market

Figure 4.2: Challenges in the Market

Figure 4.3: Opportunity Assessment in India Mango Candy Market

Figure 5.1: Recent Trends and Developments in Mango Candy Industry

Figure 6.1: Policy and Regulatory Landscape Affecting Mango Candy Market

Figure 7.1: India Mango Candy Market Size (2020-2034) – USD Billion

Figure 7.2: Market Share by Service Type

Figure 7.3: Market Share by Type of Candy

Figure 7.3.1: Hard-Boiled Candies

Figure 7.3.2: Pastilles

Figure 7.3.3: Gums

Figure 7.3.4: Jellies & Chews

Figure 7.3.5: Toffees

Figure 7.3.6: Lollipops

Figure 7.3.7: Twist & Stick Candy

Figure 7.3.8: Others

Figure 7.4: Market Share by Demographic

Figure 7.4.1: Kids

Figure 7.4.2: Teenagers & Young Adults

Figure 7.4.3: Adults

Figure 7.5: Market Share by Flavor Profile

Figure 7.5.1: Raw Mango (Kachha Aam) Flavor

Figure 7.5.2: Sweet Ripe Mango Flavor

Figure 7.5.3: Spicy and Tangy Mix

Figure 7.5.4: Artificial Mango Flavor

Figure 7.5.5: Natural Mango Flavor

Figure 7.6: Market Share by Distribution Channel

Figure 7.6.1: Conventional Stores

Figure 7.6.2: Convenience Stores and Retail Outlets

Figure 7.6.3: Kiosks and Standalone Stores

Figure 7.6.4: Online Platforms

Figure 7.7: Market Share by Competitors

Figure 7.7.1: Revenue Shares of Key Players

Figure 7.7.2: Competitive Characteristics

Figure 8.1: Forecast – Market Size by Value (2026-2034)

Figure 8.2: Forecast by Service Type

Figure 8.3: Forecast by Type of Candy

Figure 8.4: Forecast by Demographic

Figure 8.5: Forecast by Flavor Profile

Figure 8.6: Forecast by Distribution Channel

Figure 9.1: DS Group – Company Overview and Market Position

Figure 9.2: Parle Products – Company Overview and Market Position

Figure 9.3: Haldiram – Company Overview and Market Position

Figure 9.4: Perfetti Van Melle India – Company Overview and Market Position

Figure 9.5: Shadani Group – Company Overview and Market Position

Figure 9.6: Bakewell Biscuits Pvt. Ltd. – Company Overview and Market Position

Figure 9.7: Ravindra Foods Pvt. Ltd. – Company Overview and Market Position

Figure 9.8: J V Candy Company – Company Overview and Market Position

Figure 9.9: Mahabaleshwar Hill Agri Pvt. Ltd. – Company Overview and Market Position

Figure 9.10: Other Key Players Overview

Figure 10.1: Contact Details and Disclaimer

List of Table

Table 1.1: Study Objective Summary

Table 1.2: Product Definition – Mango Candy Types

Table 1.3: Market Segmentation by Type, Demographic, Flavor, and Channel

Table 1.4: Study Variables

Table 2.1: Secondary Data Sources

Table 2.2: Companies Interviewed

Table 2.3: Primary Data Collection – Interview Breakdown

Table 3.1: Executive Summary – Key Market Highlights

Table 4.1: Key Market Drivers

Table 4.2: Market Challenges

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Overview

Table 7.1: India Mango Candy Market Size (2020-2034) – USD Billion

Table 7.2: Market Share by Service Type

Table 7.3: Market Share by Type of Candy

Table 7.3.1: Hard-Boiled Candies

Table 7.3.2: Pastilles

Table 7.3.3: Gums

Table 7.3.4: Jellies & Chews

Table 7.3.5: Toffees

Table 7.3.6: Lollipops

Table 7.3.7: Twist & Stick Candy

Table 7.3.8: Others

Table 7.4: Market Share by Demographic

Table 7.4.1: Kids

Table 7.4.2: Teenagers & Young Adults

Table 7.4.3: Adults

Table 7.5: Market Share by Flavor Profile

Table 7.5.1: Raw Mango (Kachha Aam) Flavor

Table 7.5.2: Sweet Ripe Mango Flavor

Table 7.5.3: Spicy and Tangy Mix

Table 7.5.4: Artificial Mango Flavor

Table 7.5.5: Natural Mango Flavor

Table 7.6: Market Share by Distribution Channel

Table 7.6.1: Conventional Stores

Table 7.6.2: Convenience Stores and Retail Outlets

Table 7.6.3: Kiosks and Standalone Stores

Table 7.6.4: Online Platforms

Table 7.7: Market Share by Competitors

Table 7.7.1: Revenue Shares of Key Players

Table 7.7.2: Competitive Characteristics

Table 8.1: Forecast – Market Size by Value (2026-2034)

Table 8.2: Forecast by Service Type

Table 8.3: Forecast by Type of Candy

Table 8.4: Forecast by Demographic

Table 8.5: Forecast by Flavor Profile

Table 8.6: Forecast by Distribution Channel

Table 9.1: DS Group – Key Financials and Market Position

Table 9.2: Parle Products – Key Financials and Market Position

Table 9.3: Haldiram – Key Financials and Market Position

Table 9.4: Perfetti Van Melle India – Key Financials and Market Position

Table 9.5: Shadani Group – Key Financials and Market Position

Table 9.6: Bakewell Biscuits Pvt. Ltd. – Key Financials and Market Position

Table 9.7: Ravindra Foods Pvt. Ltd. – Key Financials and Market Position

Table 9.8: J V Candy Company – Key Financials and Market Position

Table 9.9: Mahabaleshwar Hill Agri Pvt. Ltd. – Key Financials and Market Position

Table 9.10: Other Key Players Overview

Top Key Players & Market Share Outlook

- DS Group

- Parle Products

- Haldiram

- Perfetti Van Melle India

- Shadani Group

- Bakewell Biscuits Pvt. Ltd.

- Ravindra Foods Pvt. Ltd.

- J V Candy Company

- Mahabaleshwar Hill Agri Pvt. Ltd.

- Others

Frequently Asked Questions