Understand The Key Trends Shaping This Market

Download Free SampleLNG Terminals Market Insights & Analysis

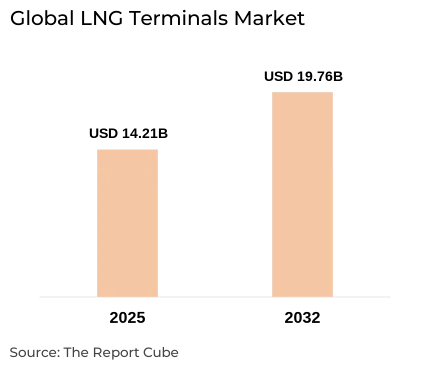

The Global LNG Terminals Market is anticipated to register a CAGR of around 4.82% during the forecast period, 2026–32. The market size is valued at approximately USD 14.21 billion in 2025 and is projected to reach around USD 19.76 billion by 2032. The increasing demand for clean energy sources & the transition toward decarbonization are driving growth in the liquefied natural gas (LNG) sector. LNG terminals, essential for LNG import & LNG export, are observing heightened investment, specifically in regions underlining energy security & diversification of energy supply chains.

Moreover, the LNG Terminals Market embraces key infrastructure like floating storage and regasification units (FSRUs), regasification terminals, and onshore storage. Also, innovations in LNG terminal design & the digitization of operations are further improving efficiency. Along with this, prominent projects such as Golden Pass LNG & Plaquemines LNG in the United States are fundamental to the global market, as they considerably contribute to nearly 30% of LNG export capacity worldwide, originating from North America.

Furthermore, governments & private sector companies are actively supporting LNG infrastructure development, for instance, in 2024, the U.S. Department of Energy sanctioned new export licenses for extended LNG terminals. Whereas, in 2025, numerous long-term agreements were signed between Asian buyers & US exporters to secure future gas supplies, strengthening global LNG supply chain dependability. Therefore, these advancements emphasize the industry’s role in ensuring energy security amidst geopolitical uncertainties & unstable energy sectors.

Additionally, looking at the LNG Terminals Market’s progression, the market outlook is predicted to be favorable, driven by mounting demand in Asia-Pacific and various other regional landscapes. Also, new project launches, strategic collaborations, and supportive regulatory frameworks would continue to transform the LNG Terminals Market landscape through 2032.

LNG Terminals Market: What Recent Innovation are Affecting the Industry?

2025:

- Cheniere Energy declared the completion of the Sabine Pass Expansion Phase 2, improving storage capacity & increasing liquefaction capacity by 6 MTPA, strengthening its supremacy among LNG export terminals in the US.

- TotalEnergies engaged in a strategic partnership with Indian Oil Corporation to develop a new regasification terminal on India’s eastern coast, aiming to meet increasing LNG import demand in South Asia & support regional energy security.

LNG Terminals Market Dynamics

-

Driver: Mounting Demand for Energy Security & Cleaner Energy Sources to Enhance Market Demand

The alteration toward cleaner energy sources & the rising focus on energy security are key drivers for the LNG Terminal Market. Also, with geopolitical tensions & variability in traditional gas supply regions, nations are investing in LNG infrastructure to expand their energy sources. Furthermore, LNG offers flexibility & decreases reliance on pipeline gas, specifically for regions such as Europe & Asia-Pacific. Along with this, countries, including Japan, India, and Germany, are rapidly expanding their regasification terminals to safeguard stable gas supplies, thus aiding in enhancing the market size.

-

Challenge: Higher Capital Investment & Prolonged Approval Processes to Hinder Growth

With encouraging growth predictions, the industry faces substantial capital necessities & extended development durations. Also, an LNG terminal building can take years & billions of dollars of investment. Additionally, attaining regulatory licenses & environmental clearances might result in delays. Further, these obstacles could discourage smaller enterprises from entering the LNG Terminal Market and limit growth in specific regions.

-

Opportunity: Expansion of Floating Storage and Regasification Units (FSRUs)

FSRUs are gaining prevalence as a flexible & cost-effective substitute to traditional onshore LNG import terminals. These units can be utilized faster & with decreased upfront investment, making them perfect for developing economies or regions with restricted space. Moreover, Bangladesh, the Philippines, and Brazil are among the nations investing in FSRU solutions to swiftly surge storage capacity & regasification infrastructure. Also, this movement brings up new opportunities for terminal operators & solution vendors.

-

Trend: Amalgamation of Digital Technologies & Smart Monitoring Systems

The amalgamation of AI, IoT, and predictive analytics is changing the operational landscape of LNG terminals. Also, smart monitoring systems assist in optimizing maintenance, decreasing operational costs, and ensuring safety compliance. Also, as demand for operational efficacy & remote monitoring expands, digital transformation is becoming a significant trend in the LNG Terminals Market. Further, market companies investing in such technologies are gaining an economic edge & improving their long-term sustainability.

LNG Terminals Market Segment-Wise Analysis

By Type:

- Gravity-based (above-ground tanks)

- Hybrid Tanks (partially buried & partially above-ground)

- Full Containment (fully below-ground)

- Submerged Tanks (fully below-ground)

The Full Containment segment dominates the market owing to its higher safety features & ability to handle huge storage capacity. These terminals are supreme for seismically active areas or parts subject to stringent environmental limitations. The double-walled structure, including both inner & exterior containment, enhances leak prevention & structural strength. Also, this sector is likely to lead the LNG Terminal Industry throughout the forthcoming period, as demand for secure & ecologically friendly storage infrastructure expands.

By Cycle Type:

- Single Cycle

- Dual Cycle

The Dual Cycle segment grasps the potential market share owing to its operational flexibility & greater efficacy in LNG regasification & storage processes. Dual cycle systems allow terminals to manage liquefaction & regasification at the same time, progressing capacity & decreasing downtime. Also, this feature is particularly crucial for high-demand LNG export facilities such as Sabine Pass, Corpus Christi, and Cameron LNG in the US, where demand fluctuates, necessitating flexible infrastructure.

Regional Projection of the LNG Terminals Industry

The Global LNG Terminals Market is geographically diversified, covering:

- North America

- Europe

- Asia-Pacific

- South America

- The Middle East & Africa

North America accounts for the potential share of the LNG Terminals Market. The region's leadership is primarily instigated by the US, which grabs the biggest share of the LNG Terminals Market across North America. Also, promising government policies, ample natural gas resources, and strong export infrastructure positions North America as a central region across the LNG trade. Moreover, the country’s increasing partnerships with Asia & Europe improve its strategic prominence in maintaining worldwide energy security & stable supply chain operations. Further, with ongoing growth & new project declarations, the nation is predicted to retain its leadership position in industry growth & innovation during the forecast period.

What Does Our LNG Terminals Market Research Study Entail?

- The LNG Terminals Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The LNG Terminals Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Type

- Gravity-based (above-ground tanks)

- Hybrid Tanks (partially buried & partially above-ground)

- Full Containment (fully below-ground)

- Submerged Tanks (fully below-ground)

- Market Share, By Cycle Type

- Single Cycle

- Dual Cycle

- Market Share, By Capacity Source

- Small-scale (less than 1 million tonnes per annum (mtpa))

- Mid-scale (1-5 mtpa)

- Large-scale (more than 5 mtpa)

- Market Share, By Purpose

- Import terminals (receiving LNG from other countries)

- Export terminals (delivering LNG to other countries)

- Peak shaving terminals (balancing supply and demand during peak periods)

- Storage terminals (storing LNG for future use)

- Market Share, By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- North America LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- By Country

- The US

- Canada

- Mexico

- The US LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Canada LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Mexico LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- South America LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Argentina LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Europe LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Type

- By Cycle Type

- By Capacity Source

- By Purpose

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- France LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- The UK LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Spain LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Italy LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- The Middle East & Africa LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Type

- By Cycle Type

- By Capacity Source

- By Purpose

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Saudi Arabia LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- South Africa LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Asia-Pacific LNG Terminals Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Type

- By Cycle Type

- By Capacity Source

- By Purpose

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- India LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Japan LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- South Korea LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Austraila LNG Terminals Market Overview (2020-2032)

- Market Share, By Type

- Market Share, By Cycle Type

- Market Share, By Capacity Source

- Market Share, By Purpose

- Competitive Outlook (Company Profile - Partila List)

- Shell

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Inpex Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sempra Energy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Engie

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Gunvor

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Glencore

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SK E

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vitol

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cheniere Energy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- TotalEnergies

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Woodside Energy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- China National Offshore Oil Corporation (CNOOC)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Trafigura

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mitsui Co.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Shell

- Disclaimer

List of Figure

Figure 1: Global LNG Terminals Market Value (USD Billion), 2020–2032

Figure 2: LNG Terminal Market Segmentation Overview

Figure 3: Breakdown of Primary Interviews by Region and Stakeholder Type

Figure 4: Key Drivers of the Global LNG Terminals Market

Figure 5: Major Challenges in LNG Infrastructure Development

Figure 6: Opportunity Assessment – LNG Demand vs. Capacity Addition Forecast

Figure 7: Regulatory and Policy Landscape: Overview by Region

Figure 8: Global LNG Terminal Market Share, by Type (2020–2032)

Figure 9: Global Market Share by Tank Type (Gravity-based, Hybrid, Full Containment, Submerged)

Figure 10: Global LNG Terminals Market Share, by Cycle Type (Single vs. Dual)

Figure 11: Global Market Share, by Capacity Source (Small-, Mid-, Large-scale)

Figure 12: LNG Terminal Market Share, by Purpose (Import, Export, Storage, Peak Shaving)

Figure 13: Regional Market Share Comparison, 2025 vs. 2032

Figure 14: Company Revenue Share in Global LNG Terminals Market, 2025

Figure 15: Competitive Landscape Characteristics – Key Players vs. Market Fragmentation

Regional Figures

Figure 16–20: North America LNG Terminals Market by Type, Cycle Type, Capacity, and Purpose

Figure 21–24: U.S. LNG Terminal Market Share by Type, Cycle Type, Capacity, and Purpose

Figure 25–28: Canada LNG Terminal Market Share by Type, Cycle Type, Capacity, and Purpose

Figure 29–32: Mexico LNG Terminal Market Share by Type, Cycle Type, Capacity, and Purpose

Figure 33–37: South America LNG Terminal Market Overview (Brazil, Argentina, Rest of SA)

Figure 38–41: Brazil LNG Terminal Market Breakdown

Figure 42–45: Argentina LNG Terminal Market Breakdown

Figure 46–52: Europe LNG Terminal Market by Country (Germany, UK, France, Spain, Italy)

Figure 53–56: Germany LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 57–60: France LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 61–64: UK LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 65–68: Spain LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 69–72: Italy LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 73–79: Middle East & Africa LNG Market Overview (UAE, Saudi Arabia, South Africa)

Figure 80–83: UAE LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 84–87: Saudi Arabia LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 88–91: South Africa LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 92–100: Asia-Pacific LNG Terminals by Country (China, India, Japan, South Korea, Australia)

Figure 101–104: China LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 105–108: India LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 109–112: Japan LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 113–116: South Korea LNG Terminals by Type, Cycle, Capacity, Purpose

Figure 117–120: Australia LNG Terminals by Type, Cycle, Capacity, Purpose

Company Profiles – Visuals

Figure 121–135: Revenue and Strategic Footprint of Key Companies (Shell, Inpex, Sempra, etc.)

List of Table

Table 1: Study Variables and Definitions

Table 2: Market Segmentation by Type, Cycle Type, Capacity Source, Purpose, and Region

Table 3: Companies Interviewed for Primary and Secondary Research

Table 4: Breakdown of Primary Interviews by Region and Stakeholder Category

Table 5: Global LNG Terminal Market Value (USD Billion), 2020–2032

Table 6: Global LNG Terminal Market Share, by Type (%)

Table 7: Global Market Share, by Tank Configuration (Gravity-based, Hybrid, etc.)

Table 8: Market Share, by Cycle Type (Single vs. Dual Cycle)

Table 9: Market Share, by Capacity Source (Small, Mid, Large-scale)

Table 10: Market Share, by Purpose (Import, Export, Peak Shaving, Storage)

Table 11: Global Market Share, by Region, 2020–2032

Table 12: Global Market Share, by Key Companies, 2025

Regional Market Tables

North America (NA)

Table 13: North America LNG Terminal Market Value, 2020–2032

Table 14: NA Market Share, by Type, Cycle, Capacity, Purpose

Table 15–17: U.S. Market Share by Segment

Table 18–20: Canada Market Share by Segment

Table 21–23: Mexico Market Share by Segment

South America (SA)

Table 24: South America LNG Terminal Market Value, 2020–2032

Table 25: SA Market Share, by Type, Cycle, Capacity, Purpose

Table 26–28: Brazil Market Share by Segment

Table 29–31: Argentina Market Share by Segment

Europe

Table 32: Europe LNG Terminal Market Value, 2020–2032

Table 33: Market Share, by Segment (Type, Cycle, Capacity, Purpose)

Table 34–36: Germany Market Share by Segment

Table 37–39: France Market Share by Segment

Table 40–42: UK Market Share by Segment

Table 43–45: Spain Market Share by Segment

Table 46–48: Italy Market Share by Segment

Middle East & Africa (MEA)

Table 49: MEA LNG Terminal Market Value, 2020–2032

Table 50: Market Share, by Type, Cycle, Capacity, Purpose

Table 51–53: UAE Market Share by Segment

Table 54–56: Saudi Arabia Market Share by Segment

Table 57–59: South Africa Market Share by Segment

Asia-Pacific (APAC)

Table 60: APAC LNG Terminal Market Value, 2020–2032

Table 61: APAC Market Share, by Segment

Table 62–64: China Market Share by Segment

Table 65–67: India Market Share by Segment

Table 68–70: Japan Market Share by Segment

Table 71–73: South Korea Market Share by Segment

Table 74–76: Australia Market Share by Segment

Top Key Players & Market Share Outlook

- Shell

- Inpex Corporation

- Sempra Energy

- Engie

- Gunvor

- Glencore

- SK E

- Vitol

- Cheniere Energy

- TotalEnergies

- Woodside Energy

- China National Offshore Oil Corporation (CNOOC)

- Trafigura

- Mitsui Co.

- Others

Frequently Asked Questions