Understand The Key Trends Shaping This Market

Download Free SampleOman Luxury Car Market Key Highlights

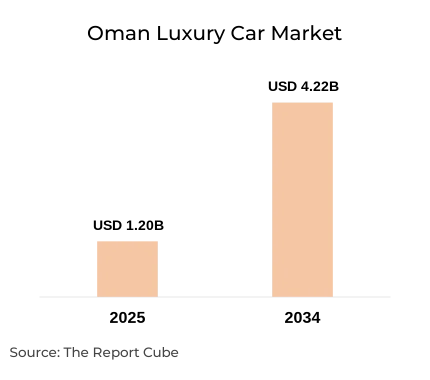

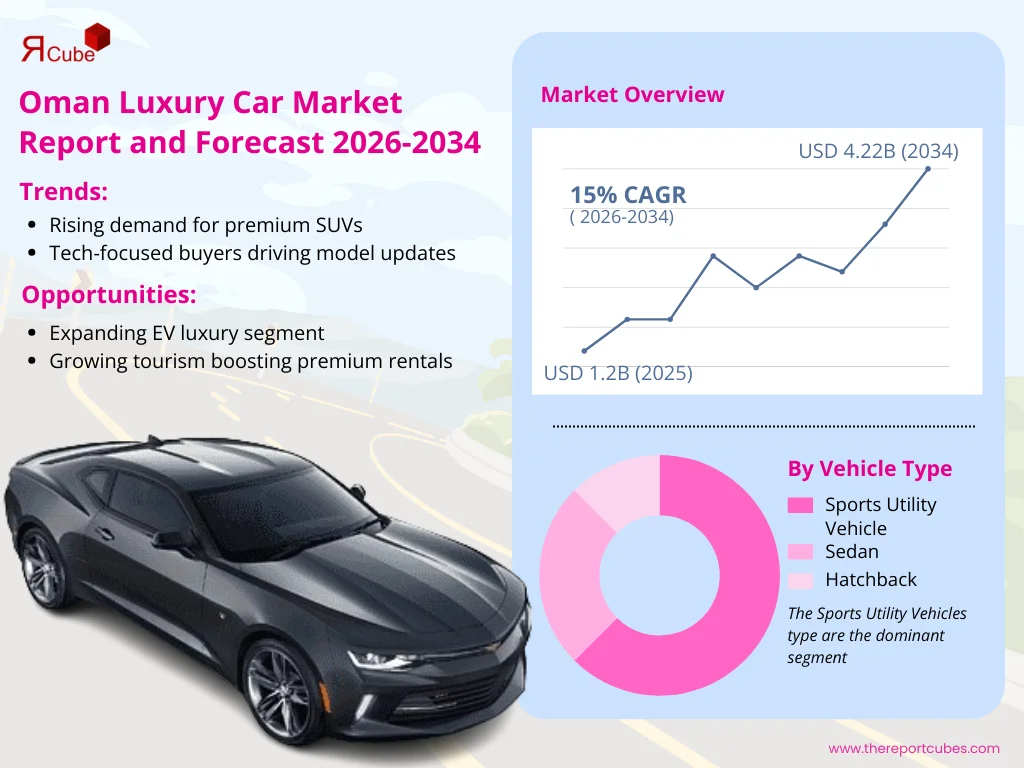

- The Oman Luxury Car Market to record a CAGR of about 15% during 2026-34.

- Estimated market value of about USD 1.2 billion by 2034 from nearly USD 4.22 billion in 2025.

- Strong demand from wealthy individuals, expats, and corporate fleets, with Muscat capturing most market sales.

- Luxury share of passenger-car revenue is increasing within an automotive market projected to flourish with the passing years.

- AI-enabled features like predictive maintenance, connected services, and ADAS drive consumer experience, while AI role-play in virtual showrooms & configurators reshapes how buyers explore models and pricing.

Oman Luxury Car Market Size & Forecast (2026–2034)

Luxury cars in Oman are high-priced, feature-rich vehicles from brands like Mercedes-Benz, BMW, Lexus, Range Rover, and Tesla, providing advanced safety, connectivity, and comfort. These appeal to affluent private purchasers, corporates, and high-income expats but remain less accessible to mass-market individuals due to pricing & ownership costs. Moreover, Oman Luxury Car Market opportunities stems from greater margins, strong aftersales & financing, and rising appetite for premium experiences, while market challenges include economic cycles, fuel-price instability, and regulatory shifts toward emissions & electrification.

Moreover, future market scope is supported by Vision 2040 goals to expand beyond oil, increase high-value services, and motivate technology adoption, which creates room for luxury EVs, digital mobility services, and data-driven aftersales, making the Oman Luxury Car Market appealing for long-term investors, dealers, and OEMs. Further, key related industries like finance & leasing, insurance, EV charging, logistics, and digital retail platforms, which together shape the market sales channels, including authorized luxury car dealerships in Oman, multi-brand showrooms, online marketplaces, and corporate fleet-leasing networks, several of which progressively utilize telematics & AI for fleet optimization.

Additionally, global OEMs such as Mercedes-Benz, BMW, Lexus, and Range Rover are among the companies impacted, as are regional distributors, leasing firms, and internet marketplaces that see an upsurge in demand for both new luxuries cars & used premium imports, mainly in Muscat. Also, while more general transportation & logistics projects expand road networks & urban hubs that surge the usage of luxury vehicles, government initiatives under Vision 2040, like diversification policies, foreign investment reforms, and early EV & charging infrastructure efforts, support the expansion of the non-oil sector & high-value automotive services. Also, triple-digit growth in high-end EVs further establishes how innovation & environmental goals would influence product mixtures & dealership strategy in the Oman Luxury Car Market by 2034.

What is the Impact of AI in the Oman Luxury Car Market?

AI adoption in the Oman Luxury Car Market is noticeable in connected cars with adaptive cruise, lane-keeping, predictive maintenance, and personalized infotainment, as well as dealer-side tools that estimate demand & optimize inventory in Muscat & other cities. Also, two notable directions such as AI-powered virtual showrooms/configurators employed by luxury dealerships to simulate test drives & specifications, and telematics-based fleet solutions for premium corporate & chauffeur vehicles that enhance safety, routing, and uptime.

Oman Luxury Car Market Dynamics

What is the key driver of the Oman Luxury Car Market?

Under Vision 2040, which proposes to double real wages & elevate private-sector employment, the primary factor is income growth among wealthy locals & foreigners, strengthened by non-oil sector expansion in logistics, tourism, and services. Further, high-net-worth Omani customers become recurring buyers of high-end sedans & SUVs as a result, maintaining Muscat's luxury car trends & developing the Bahrain Luxury Car Industry in the medium run.

What are the major challenges that affect the Oman Luxury Car Industry?

High car cost, dependence on imports, and sensitivity to macroeconomic instability in oil-related revenues—which could tighten credit & minimize discretionary spending—are some of the major market challenge. Also, luxury automobile shops in Oman face lower profits owing to regulatory & inspection needs, a small market, and competition from high-quality used imports. Also, this complicates inventory management & diminishes the impact of elevated disposable income on premium demand.

What are the future opportunities in the Oman Luxury Car Market during 2026–34?

Between 2026 & 2034, market opportunities such as increasing luxury leasing, certified pre-owned programs, and chauffeur services that appeal tourists & corporate clients under the nation’s luxury-tourism strategy. Also, insurance, cross-selling finance, and service packages allows top-selling luxury car brands in Oman & luxury car dealerships to advantage from non-oil sector expansion, improving GDP contribution luxury cars even if unit volumes remain moderate.

What trends are affecting the Oman Luxury Car Market Outlook?

A visible inclination toward high-end SUVs & crossovers, electrification at the upper end, and an upsurging inclination toward flexible ownership choices such as leasing & subscription are all noteworthy developments. Moreover, these developments support luxury car trends in Muscat, where the best luxury SUVs are becoming more & more prevalent. In addition, open pricing & internet research on subjects like Rolls-Royce Phantom & Mercedes S-Class price impact customer choices & increase brand competition.

How are the Oman Luxury Car Market Segments Defined?

The Oman Luxury Car Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Vehicle Types: Hatchback, Sedan, Sports Utility Vehicle

- Price Ranges: Entry-Level, Mid-Level, High-End, Ultra

By Vehicle Types:

The Sports Utility Vehicles type are the dominant segment, capturing a potential market share. The top luxury SUVs in Muscat are preferred by high-net-worth Omani consumers & foreigners, because to its space, off-road capability, and status, which supports Muscat's luxury car trends within the greater Omani automotive industry forecast.

By Price Ranges:

High-end & ultra-luxury vehicles account for around half of the Oman Luxury Car Market share, instigated by flagship sedans & SUVs such as the Mercedes S-Class & Rolls-Royce Phantom. Also, these premium models attract high net worth Oman buyers, substantially contributing to GDP contribution for luxury cars & maintaining strong margins for luxury car dealerships across Oman.

Oman Luxury Car Industry: Regional Insights

The Oman Luxury Car Market is geographically diversified, covering:

- Muscat

- Dhofar

- Al Batinah North

- Al Batinah South

- Dhahirah

- Rest of Oman

Muscat is the potential leader across the Oman Luxury Car Industry, accounting for a substantial share of national premium vehicle sales, due to its affluent base, dense luxury car dealerships, and strong luxury vehicle trends across Muscat, which boost regional GDP contribution for luxury cars & overall regional market.

Oman Luxury Car Market: What Recent Innovations Are Affecting the Industry?

- 2025: Mercedes-Benz introduced of updated S-Class in Muscat showrooms, solidifying flagship demand among premium buyers.

- 2025: Tesla expanded its premium EV line-up & fast-charging points supporting non-oil sustainability goals across Oman.

How does the Oman Luxury Car Market (2034) Future Outlook Appear?

Sustained Growth: Luxury car sales are anticipated to surge faster than total passenger cars, possibly delivering a mid- to high-single-digit CAGR of nearly 15% (2026-34), and attain an estimated market value of about USD 4.22 billion by 2034.

Technological Upgrade: While online transparency around products such as the Mercedes S-Class price & the Rolls-Royce Phantom shapes prospects, subsequent model generations from Mercedes, BMW, Lexus, Range Rover, Tesla, and others would deepen connectivity, efficiency, and performance, supporting premium pricing & reinforcing luxury vehicle trends in Muscat.

Future Opportunities: Increasing tourism, corporate mobility, and leasing sectors open prospects for fleets of best luxury SUVs in Muscat & executive sedans, enabling GDP contribution luxury cars to upsurge as part of non-oil sector growth & supporting the long-term Oman Luxury Car Market.

What Does Our Oman Luxury Car Market Research Study Entail?

- The Oman Luxury Car Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Oman Luxury Car Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Oman Luxury Car Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By Vehicle Types

- Hatchback

- Sedan

- Sports Utility Vehicle (SUV)

- Market Share, By Price Ranges

- Entry-Level

- Mid-Level

- High-End

- Ultra

- Market Share, By Fuel Type

- Petrol

- Diesel

- Market Share, By End-User

- Individual Consumers

- Corporate & Commercial

- Government Agencies

- Hospitality & Tourism

- Market Share, By Region (Oman Governorates/Cities)

- Muscat

- Dhofar

- Al Batinah North

- Al Batinah South

- Dhahirah

- Rest of Oman

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Oman Luxury Car Market Overview, By Vehicle Types

- Hatchback Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Sedan Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Sports Utility Vehicle (SUV) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hatchback Market Overview

- Oman Luxury Car Market Overview, By Price Ranges

- Entry-Level Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Mid-Level Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- High-End Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Ultra Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Entry-Level Market Overview

- Oman Luxury Car Market Overview, By Fuel Type

- Petrol Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Diesel Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Petrol Market Overview

- Oman Luxury Car Market Overview, By End-User

- Individual Consumers Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Corporate & Commercial Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Government Agencies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hospitality & Tourism Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Individual Consumers Market Overview

- Oman Luxury Car Market Overview, By Region

- Muscat Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Dhofar Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Al Batinah North Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Al Batinah South Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Dhahirah Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Rest of Oman Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Muscat Market Overview

- Competitive Outlook (Company Profiles)

- Mercedes-Benz

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BMW

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lexus

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Range Rover

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Audi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Porsche

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tesla

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bentley

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Rolls-Royce

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Jaguar

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mercedes-Benz

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Mercedes-Benz

- BMW

- Lexus

- Range Rover

- Audi

- Porsche

- Tesla

- Bentley

- Rolls-Royce

- Jaguar

Frequently Asked Questions