Understand The Key Trends Shaping This Market

Download Free SampleSaudi Arabia Luxury Car Market Key Highlights

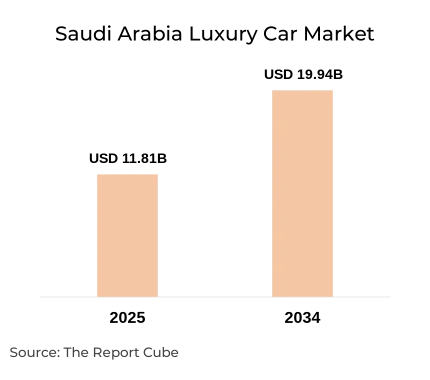

- The Saudi Arabia Luxury Car Market size in 2034 is destined to reach around USD 19.94 billion from nearly USD 11.81 billion in 2025.

- The market is expected to register a CAGR of about 5.99% from 2026–34.

- Vision 2030's effect on luxury cars is driving high-net-worth individuals across KSA to invest, supporting economic diversification & luxury automotive investment.

- Riyadh, Jeddah, and Dammam lead the national market share, encouraged by best-selling luxury SUVs in Saudi Arabia & the presence of top luxury car brands.

- AI role-play improves sales forecasting, user experience, and digital innovation, enhancing the Saudi Arabia Luxury Vehicle Market share & sales forecast.

Saudi Arabia Luxury Car Market Size & Forecast (2026–2034)

The Saudi Arabia Luxury Car Market circles premium sedans, SUVs, and technologically advanced vehicles. Its value is forecasted to be driven by Vision 2030's impact on luxury cars & rapid urbanization. Also, customer demand for electric & hybrid luxury cars propels growth, and initiatives like government EV incentives & infrastructure development improve the market scope.

Though the sector is lucrative owing to high net worth people, increasing expats, and the booming tourism sector, import taxes & financing concerns still pose a challenge for the market. Moreover, dealerships & online sales of luxury cars are thriving, with Saudi Arabia's luxury car sales projection showing double-digit upscale in premium vehicles. Also, Mercedes-Benz, Rolls-Royce, BMW, and luxury vehicle brands & dealers in Riyadh are some of the important participants assisting in improving the Saudi Arabia Luxury Car Market.

Additionally, the Luxury Car Market in Saudi Arabia is altering as a result of new initiatives & collaborations, like smart financing & virtual showrooms, as well as government assistance for sustainable transportation & economic diversification. Further, advancements & innovation and route optimization are emphasized by recent initiatives such as the Saudi Road Code for autonomous vehicles, as well as the construction of EV charging networks, which reinforce the Saudi Arabia Luxury Car Market growth in the future years.

What is the Impact of AI in the Saudi Arabia Luxury Car Market?

AI is transforming the Saudi Arabia Automotive Industry across the luxury segment via predictive maintenance, autonomous vehicles, and AI-powered traffic management. Further, two landmark projects, such as Neom City’s self-driving trials & the acceptance of virtual reality by high-end car dealerships in Riyadh, benefit the luxury car sales in Saudi Arabia.

Saudi Arabia Luxury Car Market Dynamics

What is the key driver of the Saudi Arabia Luxury Car Market?

Social Prestige as a Powerful Growth Driver: In Saudi Arabia, luxury cars are diligently tied to social stature or social status grounds for high-net-worth individuals & affluent youths. Ownership of top luxury car brands in KSA & the latest models signifies success, lifestyle, and status, fueling the market’s rapid upgrade under Vision 2030, impacting luxury cars, and supporting premium acquisitions across Riyadh & Jeddah.

What are the major challenges that affect the Saudi Arabia Luxury Car Industry?

High Import Tariffs Limiting Market Growth: By 2034, the KSA Luxury Car Market would be impacted by high tariffs on imported cars, which would restrict market expansion & raise customer costs for luxury cars. Also, these expenses discourage regular updates, which minimizes the selection of Saudi Arabia's best-selling luxury SUVs & high-end cars from international companies.

What are the future opportunities in the Saudi Arabia Luxury Car Market during 2026-34?

Rising Electric Vehicle Infrastructure as a Strategic Opportunity: The Saudi Luxury Vehicle Market growth is anticipated to be augmented owing to government investment in electric vehicle charging infrastructure. Also, economic diversification drives luxury automotive investment with new EV launches by high-end car dealers across Riyadh, making electric luxury cars more accessible & trending across the country.

What trends are affecting the Saudi Arabia Luxury Car Market Outlook?

Regional Customization Trend: Brands are focused on high-end vehicles with features such as custom interiors & desert-adapted features that are well-suited to Saudi people’s tastes. Further, as part of the Saudi Arabia Automobile Market luxury section, companies have launched customized solutions to satisfy regional preferences, representing an increasing desire for distinctive luxury experiences.

How are the Saudi Arabia Luxury Car Market Segments Defined?

The Saudi Arabia Luxury Car Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Type: Hatchback, Sedan, Sports Utility Vehicle, Others

- Fuel Type: Gasoline, Diesel, Electric, Hybrid

By Type:

The Luxury Sports Utility Vehicle (SUV) is the dominant segment among hatchbacks, sedans, others, capturing the largest Saudi Arabia Luxury Car Market share. Best-selling luxury SUVs in Saudi Arabia uphold a leading position in terms of their appeal for family comfort, off-road versatility, and premium features, making them the first choice for high-net-worth individuals & affluent families across the country.

By Fuel Type:

Gasoline luxury cars lead the Saudi Arabia Luxury Car Industry, accounting for the potential market share, followed by diesel, hybrid, and electric. Nevertheless, Vision 2030's impact on luxury cars & new EV launches is motivating an elevated thrust for hybrid & electric vehicles in the forecast years.

Saudi Arabia Luxury Car Industry: Regional Insights

The Saudi Arabia Luxury Car Market is geographically diversified, covering:

- Riyadh

- Jeddah

- Dammam

- Rest of Saudi Arabia

Geographically, Riyadh leads the KSA Luxury Car Market, commanding for a substantial market share, followed by Jeddah, and other cities across Saudi Arabia. Further, instigated by high net worth individuals, Vision 2030, influence for luxury cars, high-end car dealers, and strong luxury automotive investment, Riyadh is considered to be an innovation hub for the national market & home to top luxury car brands.

Saudi Arabia Luxury Car Market: What Recent Innovations Are Affecting the Industry?

- 2025: Lexus introduced its fully electric luxury UX model designed for Saudi urban buyers.

- 2025: Rolls-Royce launched a region-exclusive bespoke Phantom Series II, advancing custom sales figures in KSA.

How does the Saudi Arabia Luxury Car Market (2034) Future Outlook Appear?

Sustained Growth: By 2034, the Saudi Arabia Luxury Car Market value is projected to be nearly USD 19.94 billion, and would record a CGAR of around 5.99%. Aspects like economic diversification, the Vision 2030 impact on luxury cars, and the increasing high-net-worth individuals power a consistent luxury car sale across Saudi Arabia.

Technological Upgrade: The luxury segment would be instigated by electric & connected car innovations, with best-selling luxury SUVs in Saudi Arabia & models from top luxury car brands, as Mercedes-Benz and BMW, adopting smart features & sustainable drivetrains.

Future Opportunities: Vision 2030 augments luxury automotive investment & government policies supporting EV infrastructure, custom offerings, and smart mobility. Also, market opportunities arise from increasing demand for premium cars & supportive import reforms, driving the Saudi Luxury Car Market growth & transforming a prosperous future outlined across the automotive industry in the country.

What Does Our Saudi Arabia Luxury Car Market Research Study Entail?

- The Saudi Arabia Luxury Car Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Saudi Arabia Luxury Car Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Saudi Arabia Luxury Car Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By Type

- Hatchback

- Sedan

- Sports Utility Vehicle (SUV)

- Others

- Market Share, By Fuel Type

- Gasoline

- Diesel

- Electric

- Hybrid

- Market Share, By Price Range

- Entry-Level Luxury

- Mid-Level Luxury

- High-End Luxury

- Ultra-Luxury

- Market Share, By End-User

- Corporate Clients

- High-Net-Worth Individuals (HNWI)

- Government Agencies

- Tour Operators

- Rental Companies

- Others

- Market Share, By Region (Saudi Arabia Cities/Provinces)

- Riyadh

- Jeddah

- Dammam

- Rest of Saudi Arabia

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Saudi Arabia Luxury Car Market Overview, By Type

- Hatchback Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Sedan Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Sports Utility Vehicle (SUV) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Type Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hatchback Market Overview

- Saudi Arabia Luxury Car Market Overview, By Fuel Type

- Gasoline Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Diesel Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Electric Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hybrid Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Gasoline Market Overview

- Saudi Arabia Luxury Car Market Overview, By Price Range

- Entry-Level Luxury Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Mid-Level Luxury Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- High-End Luxury Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Ultra-Luxury Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Entry-Level Luxury Market Overview

- Saudi Arabia Luxury Car Market Overview, By End-User

- Corporate Clients Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- High-Net-Worth Individuals (HNWI) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Government Agencies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Tour Operators Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Rental Companies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others End-User Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Corporate Clients Market Overview

- Saudi Arabia Luxury Car Market Overview, By Region

- Riyadh Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Jeddah Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Dammam Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Rest of Saudi Arabia Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Riyadh Market Overview

- Competitive Outlook (Company Profiles)

- Lexus

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BMW

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Genesis

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mercedes-Benz

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Land Rover

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Infiniti

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Rolls-Royce

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bentley

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ferrari

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lamborghini

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lexus

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Lexus

- BMW

- Genesis

- Mercedes-Benz

- Land Rover

- Infiniti

- Rolls-Royce

- Bentley

- Ferrari

- Lamborghini

Frequently Asked Questions