Saudi Arabia Consumer Electronics Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleSaudi Arabia Consumer Electronics Market Insights & Analysis

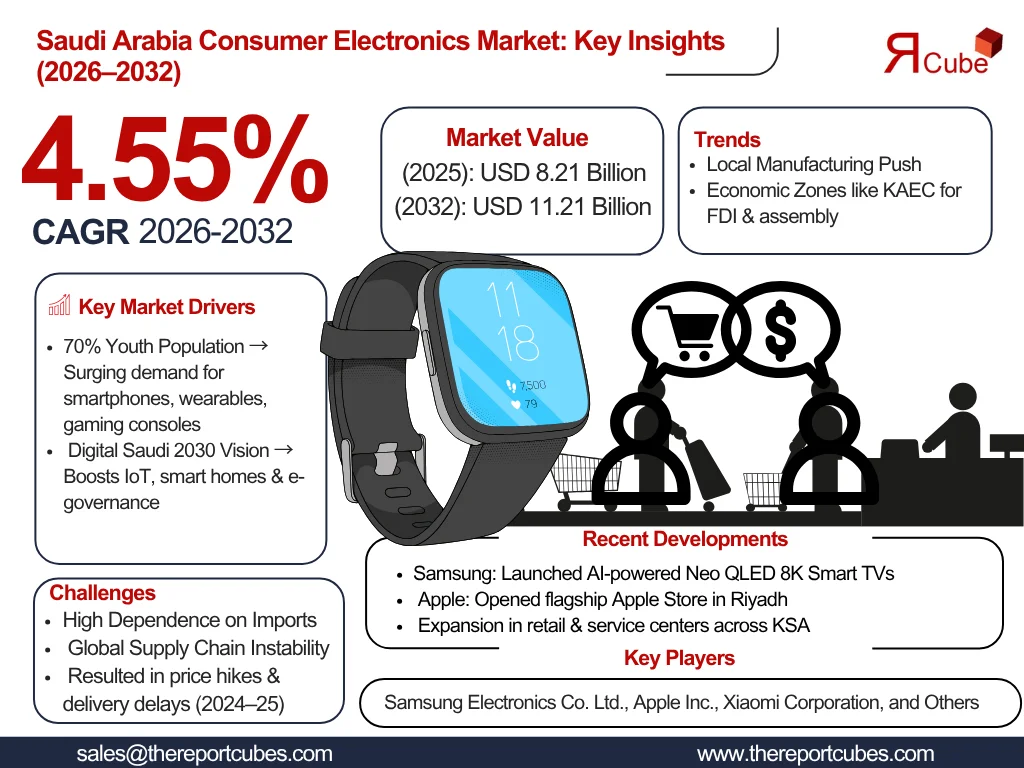

The Saudi Arabia Consumer Electronics Market is anticipated to register a CAGR of around 4.55% during the forecast period 2026–2032. The market was valued at nearly USD 8.21 billion in 2025 and is projected to reach approximately USD 11.21 billion by 2032. Rapid urbanization, growing disposable incomes, increased digital literacy, and the government's drive for digitization under Saudi Vision 2030 have all combined to create a promising environment for the customer electronics sector in Saudi Arabia.

The Saudi Arabia Consumer Electronics Market as a whole is being shaped by the surge in demand for phones, smart TVs, air conditioners, computers, and wearable technologies. Also, consumers' liking for tech-integrated lifestyles, specifically among younger demographics, is surging demand for smart & connected devices. Further, the post-pandemic demand for gaming consoles, wireless audio systems, and laptops/tablets has also been instigated by altering lifestyle demands, entertainment preferences, and hybrid working models.

Moreover, the Kingdom had a substantial proliferation in e-commerce during 2024, especially in the electronics sector. Also, the Saudi Arabia E-Commerce Market is expanding into a key force behind online electronic stores across the kingdom due to the nation's high internet penetration & prevalent usage of digital payments. Along with this, electronic acceptance is accelerating in both the residential & commercial sectors owing to initiatives such as the Digital Saudi 2030 Strategy & investments in 5G and smart city infrastructure (like NEOM).

Furthermore, in 2025, Samsung Electronics announced its flagship AI-powered Smart TVs in Saudi Arabia, fortified with Arabic-language support & improved smart home compatibility. In the meantime, Apple Inc. extended its regional retail operations by opening a new Apple Store in Riyadh, improving consumer access & after-sales services. Also, Samsung Electronics Co., Ltd. continues to lead the Saudi Arabia electronics company landscape, trailed closely by Apple Inc. & LG Corporation, specifically in segments such as TVs, smartphones, and home appliances.

Additionally, the Saudi Arabia Consumer Electronics Market incorporates a broad array of devices like computing devices, audio-visual equipment, mobile phones, TVs, white goods, and evolving tech such as wearables & drones, catering to both B2C & B2B segments. Further, looking ahead, the industry is presumed to flourish on account of embracing smart home, youth tech-savviness, growth of online electronic stores, and growing affordability of global brands during the forthcoming period.

Saudi Arabia Consumer Electronics Market Upgrades & Recent Developments

2025:

- Samsung Electronics Co., Ltd. introduced its Neo QLED 8K Smart TV series across the Saudi market in 2025, highlighting AI-optimized visuals, seamless smart home incorporation, and sustainability-driven production.

- Apple Inc. opened a new Apple retail store in Riyadh in 2025 as part of its GCC expansion strategy, with improved service centers & elite early access to flagship launches such as the Apple Vision Pro.

Saudi Arabia Consumer Electronics Market Dynamics

-

Driver: Increasing Tech-Savvy Population & Digital Amalgamation to Drive the Market

A youthful & digitally inclined population is considerably driving the Saudi Arabia Consumer Electronics Market. Also, with over 70% of the population under the age of 35, demand for wearables, laptops, smartphones, and gaming consoles is augmenting. Moreover, Saudi Vision 2030’s digital revolution agenda is generating a promising ecosystem for smart living, IoT, and e-governance, motivating the incorporation of electronics across all daily functions.

-

Challenge: Dependence on Imports & Global Supply Chain Instability to Hamper Growth

A key restraint for the Saudi Arabia Consumer Electronic Market is its dependence on imports for high-tech components & finished goods. Also, global chip shortages, shipping delays, and price instability in 2024–25 caused inventory disruptions in foremost electronics stores in Saudi Arabia, growing customer delay times & inflating prices. Furthermore, reliance on foreign OEMs makes local companies vulnerable to geopolitical variations.

-

Opportunity: Expansion of Local Manufacturing & Retail Ecosystem

Saudi Arabia is focused on localizing the manufacturing of consumer electronics via strategic alliances, FDI incentives, and economic zones like KAEC. Also, in the long run, this could decrease the price of electronics in Saudi Arabia by letting foreign electronics companies to set up local assembly and R&D facilities. Moreover, strong sales prospects are also presented by the expansion of online platforms & surging local retail investments.

-

Trend: Smart Home Ecosystem & AI-Powered Devices to Enhance Market Share

The amalgamation of consumer electronics into smart home ecosystems is one of the key trends prompting the Saudi Arabia Consumer Electronics Market. Smart TVs, voice assistants, connected air conditioners, and refrigerators with AI built in are among the gadgets that are becoming more & more common. Also, consumers' demands for seamless user experiences & interoperability are driving brands to develop & offer unified solutions, chiefly through IoT-based platforms & wireless technologies.

Saudi Arabia Consumer Electronics Market Segment-Wise Analysis

By Market Structure:

- Smartphones & Mobile Phones

- Televisions (LED, OLED, Smart TVs, etc.)

- Laptops, Notebooks, & Tablets

- Air Conditioners & Refrigerators

- Washing Machines & Dishwashers

- Audio & Video Devices

- Cameras & Camcorders

- Gaming Consoles & Accessories

- Wearable Electronics

- Others

The Smartphones & Mobile Phones segment leads the Saudi Arabia Consumer Electronics Market. This is due to the prevalent usage of mobile devices, regular product updates, and status association. Apple's flagship releases & Xiaomi and Samsung's reasonably valued mid-range devices have largely expanded the possibilities available to customer. Also, as the Kingdom places a solid focus on digital identification, fintech, and social media connectivity, smartphones continue to be an essential tool, assisted along by competitive pricing & telco-backed installment plans.

By Connectivity Type:

- Wired

- Wireless (Bluetooth, Wi-Fi, etc.)

The Wireless devices segment are dominating in the Saudi Arabia Consumer Electronic Market, accounting for the potential market share. The prevalence of wearable technology, smart TVs, smart speakers, Bluetooth headphones, and wireless printers has contributed to the segment's supremacy. Also, devices having Bluetooth & Wi-Fi capabilities are favored by customers owing to their compatibility with smart home systems, ease of use, and remote access. Moreover, the trend accelerates the transition from wired to wireless solutions & is in line with Saudi Arabia's nationwide 5G rollout & increasing prominence on tech-driven living spaces.

What Does Our Saudi Arabia Consumer Electronics Market Research Study Enail?

- The Saudi Arabia Consumer Electronics Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Saudi Arabia Consumer Electronics Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Saudi Arabia Consumer Electronics Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Market Structure

- Smartphones & Mobile Phones

- Televisions (LED, OLED, Smart TVs, etc.)

- Laptops, Notebooks, & Tablets

- Air Conditioners & Refrigerators

- Washing Machines & Dishwashers

- Audio & Video Devices

- Cameras & Camcorders

- Gaming Consoles & Accessories

- Wearable Electronics

- Others

- Market Share, By Connectivity Type

- Wired

- Wireless (Bluetooth, Wi-Fi, etc.)

- Market Share, By Product Type

- Electronic Devices

- Consumer Appliances

- Others

- Market Share, By Booking Type

- Online Booking

- Offline Booking

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Saudi Arabia Smartphones & Mobile Phones Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Televisions (LED, OLED, Smart TVs, etc.) Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Laptops, Notebooks, & Tablets Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Air Conditioners & Refrigerators Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Washing Machines & Dishwashers Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Audio & Video Devices Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Cameras & Camcorders Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Gaming Consoles & Accessories Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Wearable Electronics Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Others Consumer Electronics Market Overview, 2020-2032F

- By Value (USD Million)

- By Connectivity Type- Market Size & Forecast 2019-2030, USD Million

- By Product Type- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Samsung Electronics Co. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Apple Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Xiaomi Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LG Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lenovo Group Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sony Group Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dell Technologies Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- HP Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Panasonic Holdings Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Samsung Electronics Co. Ltd.

- Contact Us & Disclaimer

List of Figure

Figure 1: Saudi Arabia Consumer Electronics Market Value, 2020–2032 (USD Billion)

Figure 2: Market Share by Market Structure, 2024 (%)

Figure 3: Market Share of Smartphones & Mobile Phones, 2024 (%)

Figure 4: Market Share of Televisions (LED, OLED, Smart TVs), 2024 (%)

Figure 5: Market Share of Laptops, Notebooks, & Tablets, 2024 (%)

Figure 6: Market Share of Air Conditioners & Refrigerators, 2024 (%)

Figure 7: Market Share of Washing Machines & Dishwashers, 2024 (%)

Figure 8: Market Share of Audio & Video Devices, 2024 (%)

Figure 9: Market Share of Cameras & Camcorders, 2024 (%)

Figure 10: Market Share of Gaming Consoles & Accessories, 2024 (%)

Figure 11: Market Share of Wearable Electronics, 2024 (%)

Figure 12: Market Share by Connectivity Type (Wired vs. Wireless), 2024 (%)

Figure 13: Market Share by Product Type (Electronic Devices vs. Appliances), 2024 (%)

Figure 14: Market Share by Booking Type (Online vs. Offline), 2024 (%)

Figure 15: Market Share by Competitor (Top 5 Players), 2024 (%)

Product-wise Market Figures (By Value and Segments)

Figure 16: Smartphones & Mobile Phones Market Size, 2020–2032 (USD Million)

Figure 17: Smartphones Market by Connectivity Type, 2019–2030 (USD Million)

Figure 18: Smartphones Market by Product Type, 2019–2030 (USD Million)

Figure 19: Televisions Market Size, 2020–2032 (USD Million)

Figure 20: Televisions by Connectivity Type, 2019–2030 (USD Million)

Figure 21: Televisions by Product Type, 2019–2030 (USD Million)

Figure 22: Laptops, Notebooks, & Tablets Market Size, 2020–2032 (USD Million)

Figure 23: Laptops by Connectivity Type, 2019–2030 (USD Million)

Figure 24: Laptops by Product Type, 2019–2030 (USD Million)

Figure 25: Air Conditioners & Refrigerators Market Size, 2020–2032 (USD Million)

Figure 26: AC & Refrigerators by Connectivity Type, 2019–2030 (USD Million)

Figure 27: AC & Refrigerators by Product Type, 2019–2030 (USD Million)

Figure 28: Washing Machines & Dishwashers Market Size, 2020–2032 (USD Million)

Figure 29: Washing Machines by Connectivity Type, 2019–2030 (USD Million)

Figure 30: Washing Machines by Product Type, 2019–2030 (USD Million)

Figure 31: Audio & Video Devices Market Size, 2020–2032 (USD Million)

Figure 32: Audio & Video by Connectivity Type, 2019–2030 (USD Million)

Figure 33: Audio & Video by Product Type, 2019–2030 (USD Million)

Figure 34: Cameras & Camcorders Market Size, 2020–2032 (USD Million)

Figure 35: Cameras by Connectivity Type, 2019–2030 (USD Million)

Figure 36: Cameras by Product Type, 2019–2030 (USD Million)

Figure 37: Gaming Consoles & Accessories Market Size, 2020–2032 (USD Million)

Figure 38: Gaming Consoles by Connectivity Type, 2019–2030 (USD Million)

Figure 39: Gaming Consoles by Product Type, 2019–2030 (USD Million)

Figure 40: Wearable Electronics Market Size, 2020–2032 (USD Million)

Figure 41: Wearables by Connectivity Type, 2019–2030 (USD Million)

Figure 42: Wearables by Product Type, 2019–2030 (USD Million)

Figure 43: Others Consumer Electronics Market Size, 2020–2032 (USD Million)

Figure 44: Others by Connectivity Type, 2019–2030 (USD Million)

Figure 45: Others by Product Type, 2019–2030 (USD Million)

Primary Research & Competitive Landscape

Figure 46: Breakdown of Primary Interviews (By Designation, Company Type, Geography)

Figure 47: Competitive Revenue Share, 2024 (%) – Top Players

Figure 48: Recent Strategic Partnerships and Alliances – Key Players

Figure 49: SWOT Analysis – Top 3 Companies

List of Table

Table 1: Objective of the Study

Table 2: Product Definition – Consumer Electronics Categories

Table 3: Market Segmentation Criteria

Table 4: Study Variables and Data Points Considered

Table 5: List of Companies Interviewed (Primary Research Respondents)

Table 6: Breakdown of Primary Interviews – By Region, Designation, and Company Type

Market Overview Tables

Table 7: Saudi Arabia Consumer Electronics Market Size, 2020–2032 (USD Billion)

Table 8: Market Share by Market Structure, 2024 (%)

Table 9: Market Share by Connectivity Type (Wired vs. Wireless), 2024 (%)

Table 10: Market Share by Product Type (Devices, Appliances, Others), 2024 (%)

Table 11: Market Share by Booking Type (Online vs. Offline), 2024 (%)

Table 12: Market Share by Key Competitors, 2024 (%)

Category-Wise Market Data Tables

Each of the following categories includes three tables: overall value, by connectivity, and by product type.

Smartphones & Mobile Phones

Table 13: Market Size by Value, 2020–2032 (USD Million)

Table 14: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 15: Market Size by Product Type, 2019–2030 (USD Million)

Televisions (LED, OLED, Smart TVs, etc.)

Table 16: Market Size by Value, 2020–2032 (USD Million)

Table 17: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 18: Market Size by Product Type, 2019–2030 (USD Million)

Laptops, Notebooks, & Tablets

Table 19: Market Size by Value, 2020–2032 (USD Million)

Table 20: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 21: Market Size by Product Type, 2019–2030 (USD Million)

Air Conditioners & Refrigerators

Table 22: Market Size by Value, 2020–2032 (USD Million)

Table 23: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 24: Market Size by Product Type, 2019–2030 (USD Million)

Washing Machines & Dishwashers

Table 25: Market Size by Value, 2020–2032 (USD Million)

Table 26: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 27: Market Size by Product Type, 2019–2030 (USD Million)

Audio & Video Devices

Table 28: Market Size by Value, 2020–2032 (USD Million)

Table 29: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 30: Market Size by Product Type, 2019–2030 (USD Million)

Cameras & Camcorders

Table 31: Market Size by Value, 2020–2032 (USD Million)

Table 32: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 33: Market Size by Product Type, 2019–2030 (USD Million)

Gaming Consoles & Accessories

Table 34: Market Size by Value, 2020–2032 (USD Million)

Table 35: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 36: Market Size by Product Type, 2019–2030 (USD Million)

Wearable Electronics

Table 37: Market Size by Value, 2020–2032 (USD Million)

Table 38: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 39: Market Size by Product Type, 2019–2030 (USD Million)

Others

Table 40: Market Size by Value, 2020–2032 (USD Million)

Table 41: Market Size by Connectivity Type, 2019–2030 (USD Million)

Table 42: Market Size by Product Type, 2019–2030 (USD Million)

Competitive Landscape Tables

Table 43: Revenue Shares of Key Companies, 2024 (%)

Table 44: Strategic Alliances & Partnerships – Leading Companies

Table 45: Recent Developments (M&A, Product Launches, Expansion)

Table 46: Company Comparison Matrix – Product Offering & Strengths

Top Key Players & Market Share Outlook

- Samsung Electronics Co. Ltd.

- Apple Inc.

- Xiaomi Corporation

- LG Corporation

- Lenovo Group Limited

- Sony Group Corporation

- Dell Technologies Inc.

- HP Inc.

- Panasonic Holdings Corporation

- Alphabet Inc.

- Daikin Industries Ltd.

- Others

Frequently Asked Questions