UAE Digital (IT) Services Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleThe UAE Digital Services Market Insights & Analysis

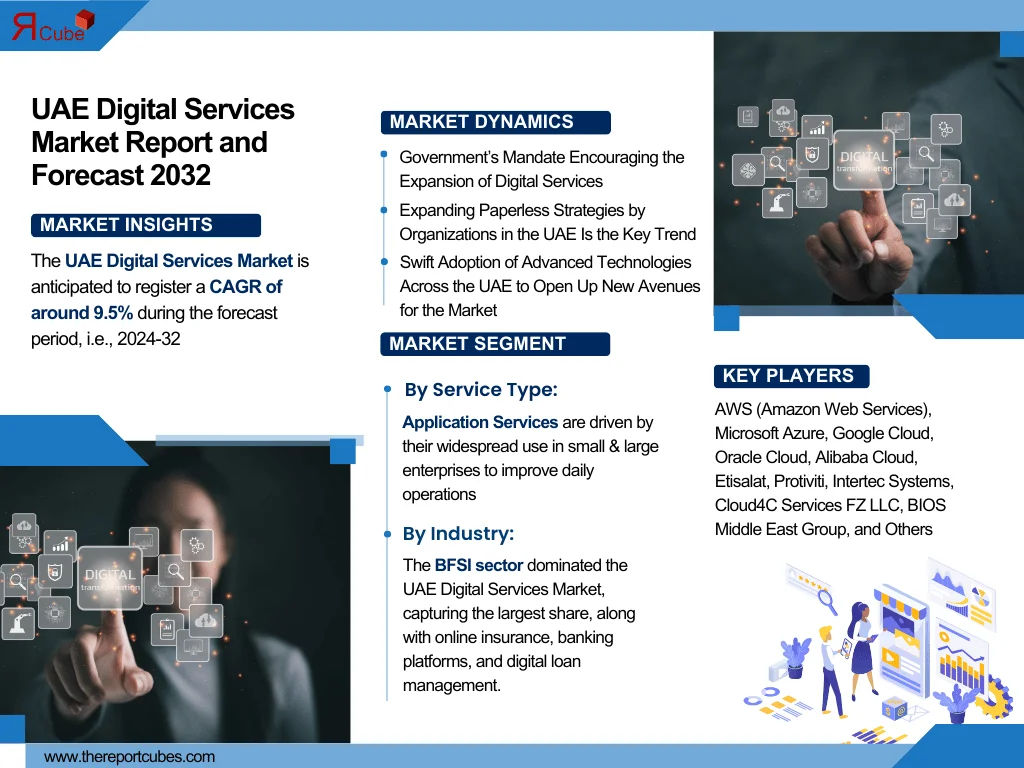

The UAE Digital Services Market is valued at USD 5.5 Billion in 2024 and is further anticipated to register a CAGR of around 9.5% during the forecast period, i.e., 2024-32. Digital Services deliver electronic content to end-users via devices like smartphones & computers to enhance business functions, culture, and customer experiences while adapting to changing business requirements. The UAE is the business hub of the Middle East & Africa, with booming BFSI & IT industries. These industries are attracting foreign investments while digital transactions are increasing rapidly.

Additionally, the government of the country is proactive in ensuring the last-mile delivery of social benefits to its citizens. Thus, the growing trend of paperless strategies & the vision of Smart UAE entwined with digital governance have encouraged market expansion for the past few years. Moreover, several leading companies are also launching innovative & upgraded digital services to provide better service. For example, in 2023, the General Pension and Social Security Authority (GPSSA) proclaimed that it would unveil 23 upgraded digital services on its website.

The UAE's Pension Authority is aligning its digital transformation services with the government's vision to improve flexibility, convenience, and overall stakeholder satisfaction. Hence, these digitally transforming initiatives & advancements would contribute to enhancing the UAE Digital Services Market size in the forthcoming years.

The UAE Digital Services Market Dynamics

- Government’s Mandate Encouraging the Expansion of Digital Services

In a bid to make the UAE a smart country, the government is coming up with numerous initiatives, such as the UAE Digital Government Strategy 2025, which covers eight dimensions facilitating the upliftment & advancements of the country. Likewise, a new law was introduced in Dubai in 2022, requiring the provision of digital services. Under this, all entities, including government entities, judicial authorities, and private organizations in Dubai, must provide digital services once the implementation phases are determined. Compliance is mandatory within one year, based on the organization's implementation phase, and no additional fees should be imposed on those who use their services.

Furthermore, the law permits entities to outsource digital services' provision, management, and operation to a public or private company authorized by Dubai's General Secretariat and the Department of Finance (DOF). These services must adhere to the cybersecurity & data protection standards established by the Dubai Electronic Security Center and digital payment methods adopted by the DOF & should be accessible in Arabic and English, with features to accommodate people with disabilities. Thus, the rising initiatives & enactments by the government of the country are supporting the growth of the UAE Digital Services Market.

- Expanding Paperless Strategies by Organizations in the UAE Is the Key Trend

Electronic signatures are legally recognized in the UAE, and recent reforms have strengthened the existing regulations. It carries the same legal weight as physical ones and can be used for various civil & commercial transactions, including marriage, personal status, notary, and real estate services such as buying, selling, renting, and amending contracts. Hence, such e-signatures are gradually gaining acceptance among organizations in the UAE due to the ongoing digital revolution. In fact, in December 2021, the Dubai government announced that it had become entirely paperless.

All government operations, transactions, and processes are now online through an integrated platform, providing UAE citizens with a smart, convenient, and improved life. Therefore, this strategic move is expected to boost the adoption of digital signatures nationwide in the coming years, further pushing the UAE Digital Services Market.

- Swift Adoption of Advanced Technologies Across the UAE to Open Up New Avenues for the Market

The UAE has been at the forefront of accepting advanced technologies in the Middle East, including cloud computing, Blockchain, Artificial Intelligence (AI), facial biometrics, and Machine Learning. Therefore, digital services have promptly been adopted in various sectors, such as BFSI, telecom, government, healthcare, and oil & gas. In addition, the government's policies, supporting process automation, a paperless economy, and Industry 4.0, have further increased the demand for digital services like cloud services, business automation, and analytics across the country, thus creating opportunistic arena for the UAE Digital Services Market growth during the forecast period.

The UAE Digital Services Market Segment-wise Analysis

By Service Type:

- Application Services

- Data & Analytics

- Intelligent Automation

- Cloud Services

- Strategy & Consulting

Application Services are driven by their widespread use in small & large enterprises to improve daily operations. The adoption of cloud architecture has also contributed significantly to adopting application services such as ERPs, CRMs, and document management systems. Cloud-based solutions offer affordability, scalability, and low latency, making them an attractive option for businesses of all sizes. Digital service providers have also partnered with end-users to deliver digital solutions effectively.

Furthermore, the demand for electronic signature solutions like DocuSign has been rising, supported by the UAE government's push for a paperless economy and regulations promoting electronic signatures for document verification, encouraging the UAE Digital Services Market share in the future years.

By Industry:

- BFSI

- IT & Telecommunications

- Retail

- Government

- Healthcare

- Petrochemicals and Oil & Gas

- Others

The BFSI sector dominated the UAE Digital Services Market, capturing the largest share, along with online insurance, banking platforms, and digital loan management. For example, the UAE Central Bank's FIT program aims to boost digital transformation with initiatives such as a new digital currency, open finance, eKYC, and an innovation hub.

Additionally, a unified, secure, and efficient card payment platform would support e-commerce & digital transactions in the country. The Central Bank expects these digital infrastructures to improve regulatory compliance, reduce costs, enhance innovation & customer experience, and strengthen security and operational resilience, further enhancing the market growth.

What Does Our UAE Digital Services Market Research Study Entail?

- The UAE Digital Services Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Digital Services Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Key Factors Considered by Companies While Selecting a Vendor

- Key Strategies Adopted by Vendors

- UAE IT Services Market Overview (2020-2032)

- Market Size (in USD Millions)

- UAE IT Services Market Share, By Service Type (USD Million)

- By Application Services

- Document Management System

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Supply Chain Management (SCM)

- E-Signature Solutions

- Others (Custom Applications, Web Services/ Portals, Mobile Applications, etc.)

- By Data & Analytics

- Business Intelligence & Data Warehouse

- Data Discovery

- Data Management

- Others (Pattern Matching, ML Platform, Spend Analytics, etc.)

- By Intelligent Automation

- Robotic Process Automation

- Business Process Management

- Virtual Assistants

- Low-Code Platform

- Others (Smart Workflows, Recruitment Talent Management, etc.)

- By Cloud Services

- API Web Services

- Cloud Security

- Migration Services

- Collaboration Services

- Workplace Experience Solutions

- Others (Monitoring Services, etc.)

- By Strategy & Consulting

- Architecture Designing

- Integration

- User Experience

- Technology Consulting

- Cybersecurity Strategy

- Others (Data Strategy, Change Management, etc.)

- By Application Services

- UAE IT Services Market Share, By Organization Type (USD Million)

- Government

- Non-Government

- UAE IT Services Market Share, By End User Industry Type (USD Million)

- BFSI

- IT & Telecommunications

- Retail

- Healthcare

- Petrochemicals and Oil & Gas

- Others (Transportation, Energy & Utilities, Manufacturing, etc.)

- UAE IT Services Market Share, By Region Type (USD Million)

- Dubai

- Abu Dhabi & Al Ain

- Sharjah and Northern Emirates

- UAE IT Services Market Share, By Company (In Percentage)

- Competition Characteristics

- Revenue Shares & Analysis

- Dubai IT Services Market Overview (2020-2032)

- Market Size (in USD Millions)

- Dubai IT Services Market Share, By Service Type (USD Million)

- Competitive Outlook (Company Profiles – Partial List)

- AWS (Amazon Web Services)

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Google Cloud

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Oracle Cloud

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Alibaba Cloud

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Etisalat

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Intersec System

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Cloud4C Services

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- BIOS Middle East Group

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Orixcom

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- eHosting Datafort

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Others

- AWS (Amazon Web Services)

- Contact Us & Disclaimer

List of Figure

Introduction & Methodology

Figure 1: Market Segmentation Overview

Figure 2: Study Variables Framework

Figure 3: Research Methodology Flowchart

Figure 4: Secondary Data Points Used

Figure 5: Companies Interviewed by Region/Type

Figure 6: Breakdown of Primary Interviews

Executive Summary & Market Dynamics

Figure 7: Key Market Drivers

Figure 8: Key Market Challenges

Figure 9: Opportunity Assessment Matrix

Figure 10: Recent Trends and Developments Timeline

Figure 11: Vendor Selection Key Factors

Figure 12: Vendor Strategies Adoption

UAE IT Services Market Overview (2020-2032)

Figure 13: UAE IT Services Market Size (USD Millions)

Figure 14: UAE IT Services Market Share by Service Type

Figure 15: Market Share by Application Services Segment

Figure 16: Market Share by Data & Analytics Segment

Figure 17: Market Share by Intelligent Automation Segment

Figure 18: Market Share by Cloud Services Segment

Figure 19: Market Share by Strategy & Consulting Segment

Figure 20: Market Share by Organization Type

Figure 21: Market Share by End User Industry

Figure 22: Market Share by Region Type

Figure 23: Market Share by Company (Percentage)

Competition Characteristics & Revenue Analysis

Figure 24: Competitive Landscape Overview

Figure 25: Revenue Shares of Top Players

Dubai IT Services Market Overview (2020-2032)

Figure 26: Dubai IT Services Market Size (USD Millions)

Figure 27: Dubai IT Services Market Share by Service Type

Company Profiles & Competitive Outlook

Figure 28: AWS – Business Segments & Strategic Alliances

Figure 29: Google Cloud – Business Segments & Strategic Alliances

Figure 30: Oracle Cloud – Business Segments & Strategic Alliances

Figure 31: Alibaba Cloud – Business Segments & Strategic Alliances

Figure 32: Etisalat – Business Segments & Strategic Alliances

Figure 33: Intersec System – Business Segments & Strategic Alliances

Figure 34: Cloud4C Services – Business Segments & Strategic Alliances

Figure 35: BIOS Middle East Group – Business Segments & Strategic Alliances

Figure 36: Orixcom – Business Segments & Strategic Alliances

Figure 37: eHosting Datafort – Business Segments & Strategic Alliances

List of Table

Introduction & Methodology

Table 1: Objectives of the Study

Table 2: Product Definitions

Table 3: Market Segmentation Details

Table 4: Study Variables Description

Table 5: Secondary Data Sources

Table 6: Companies Interviewed

Table 7: Primary Data Points Summary

Table 8: Breakdown of Primary Interviews

Executive Summary & Market Dynamics

Table 9: Market Drivers Summary

Table 10: Market Challenges Summary

Table 11: Opportunity Assessment Details

Table 12: Recent Trends and Developments Highlights

Table 13: Key Factors for Vendor Selection

Table 14: Key Strategies Adopted by Vendors

UAE IT Services Market Overview (2020-2032)

Table 15: UAE IT Services Market Size Forecast (USD Million)

Table 16: Market Share by Service Type

Table 17: Application Services Segmentation and Market Share

Table 18: Data & Analytics Segmentation and Market Share

Table 19: Intelligent Automation Segmentation and Market Share

Table 20: Cloud Services Segmentation and Market Share

Table 21: Strategy & Consulting Segmentation and Market Share

Table 22: Market Share by Organization Type

Table 23: Market Share by End User Industry

Table 24: Market Share by Region Type

Table 25: Market Share by Company (Percentage)

Competition & Revenue

Table 26: Competition Characteristics Overview

Table 27: Revenue Shares & Analysis

Dubai IT Services Market Overview (2020-2032)

Table 28: Dubai IT Services Market Size Forecast (USD Million)

Table 29: Dubai IT Services Market Share by Service Type

Company Profiles & Competitive Outlook

Table 30: AWS – Company Overview & Financials

Table 31: Google Cloud – Company Overview & Financials

Table 32: Oracle Cloud – Company Overview & Financials

Table 33: Alibaba Cloud – Company Overview & Financials

Table 34: Etisalat – Company Overview & Financials

Table 35: Intersec System – Company Overview & Financials

Table 36: Cloud4C Services – Company Overview & Financials

Table 37: BIOS Middle East Group – Company Overview & Financials

Table 38: Orixcom – Company Overview & Financials

Table 39: eHosting Datafort – Company Overview & Financials

Top Key Players & Market Share Outlook

- AWS (Amazon Web Services)

- Microsoft Azure

- Google Cloud

- Oracle Cloud

- Alibaba Cloud

- Etisalat

- Protiviti

- Intertec Systems

- Cloud4C Services FZ LLC

- BIOS Middle East Group

- Orixcom

- eHosting Datafort

- DATAMATICS Global FZ LLC

- Others

Frequently Asked Questions