Understand The Key Trends Shaping This Market

Download Free SampleSouth Korea Microgrid Market Analysis & Insights

What is the anticipated CAGR & size of the South Korea Microgrid Market?

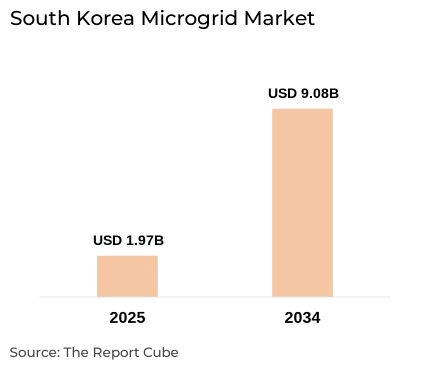

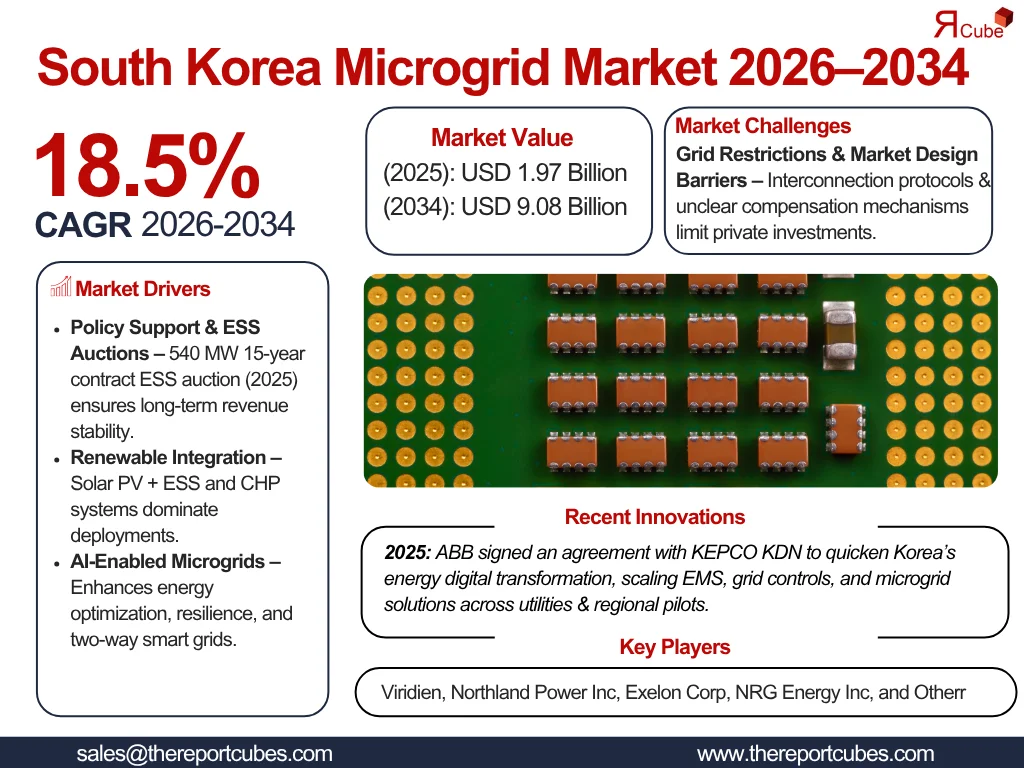

The South Korea Microgrid Market is anticipated to register a CAGR of around 18.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 1.97 billion in 2025 and is projected to reach nearly USD 9.08 billion by 2034.

Market Analysis & Insights

The South Korea Microgrid Market is swiftly growing as the country pursues carbon neutrality goals & greater shares of renewables under national plans. Also, recent market revenue aids in the growth, which is powered by large ESS auctions (the 2025 central ESS auction opened 540 MW capacity with 15-year contracts), utility pilot programs, and government pilots for AI-enabled microgrids, specifically in provinces, such as Jeonnam, where AI pilots & regional investment are concentrated.

Moreover, leading related industries include renewable generation (Solar PV, wind), battery ESS manufacturing, and grid operators (KEPCO/KDN), while system integrators & global vendors (Siemens, ABB) supply EMS, controls, and digital solutions. Also, recent activity includes reinforced policy support for distributed energy resources (DERs), ESS market design refinements, and strategic industry partnerships to augment modular & hybrid microgrids.

Furthermore, the future market outlook for the South Korea Microgrid Market seems to be promising, owing to the point to brisk market revenue growth, which is driven by investment, technology trends (digital twins, EMS), solid cold chain for ESS utilization, and integrated DER rollouts in commercial, island, and industrial use cases.

Impact of AI in the South Korea Microgrid Market

AI improves microgrid viability in South Korea by forecasting supply/demand, optimizing dispatch in Solar PV, ESS & CHP, enabling autonomous EMS control, and refining resilience, elevating rollouts of two-way, smart, renewable-friendly microgrids.

South Korea Microgrid Market Dynamics

What driving factor acts as a positive influencer for the South Korea Microgrid Market?

- Policy Support & Large-Scale ESS Auctions to Instigate Industry Growth: Long-term revenue stability is being instigted by government-backed programs & the 2025 Energy Storage System (ESS) auction (540 MW, 15-year contracts). By promising developers and investors to expand microgrid & integrated solar PV + ESS projects, these programs enhance Korea's grid flexibility, renewable energy dependability, and private sector involvement in distributed energy industries.

What are the challenges that affect the South Korea Microgrid Market?

- Grid Restrictions & Market Design Barriers to Limit Expansion: South Korea’s current interconnection protocols & wholesale market guidelines often limit the economic viability of distributed storage & microgrids. Also, unclear compensation mechanisms, restricting capacity thresholds, and regulatory delays hampers investor confidence. Further, these structural obstacles slow private deployment of energy storage systems (ESS) & decrease returns on decentralized energy assets.

How are the future opportunities transforming the market during 2026-34?

- AI-Powered Smart Microgrids & Pilot Projects: Artificial intelligence (AI)-enabled microgrids that incorporate renewables, optimize dispatch, and diminish energy curtailment are being advanced by provincial & APEC-supported pilots in Jeonnam & other regions. Also, these smart systems open up new opportunities for industrial parks, campuses, and utilities looking for sustainable, low-carbon power networks by encouraging two-way energy trading & community-based business models.

What market trends are affecting the South Korea Microgrid Market Outlook?

- Domestic ESS Manufacturing & Strategic Alliances: Large Korean companies, including SK On are expanding into the production of ESSs, and local knowledge of energy management & battery control systems is being improved by partnerships such as ABB–KDN & Siemens Korea's digital cooperation. Also, through these partnerships, Korea's leadership in cutting-edge microgrid & ESS infrastructure is strengthened, import dependency is minimized, and technological incorporation is augmented.

How is the South Korea Microgrid Market Defined as per Segments?

The South Korea Microgrid Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Power Source: Natural Gas, CHP (Combined Heat & Power), Solar PV-plus-ESS, Diesel, Fuel Cell, and Others

- Product Outlook: Remote, Grid Connected, and Hybrid

By Power Source:

CHP (Combined Heat & Power) & Solar PV-plus-ESS dominate the South Korea Microgrid Market, capturing potential market share. South Korea’s microgrid deployments, with CHP is historically generating large revenue shares owing to industrial cogeneration applications. Nevertheless, Solar PV + ESS is also the fastest-growing combination as renewables targets & ESS auctions enable firming solutions for islanded & grid-connected microgrids. Also, CHP remains fundamental for industrial parks & district heating usages, further supporting strong market growth.

By Product Outlook:

The Grid-connected Microgrids segment leads the South Korea Microgrid Market by accounting for the potential market share. The is because the segment could provide flexibility services, participate in ESS auctions, and interact with KEPCO’s distribution network. Also, grid-connected systems deliver commercial value through ancillary services, PPA arrangements, and congestion relief, while hybrid microgrids (solar+ESS+CHP) develop for resilience & islanding capability in industrial and remote areas. Further, policy & auction structures favor grid-connected deployments with long-term revenue contracts, hence enhancing market outlook.

South Korea Microgrid Market: What Recent Innovations Are Affecting the Industry?

- 2025: ABB signed an agreement with KEPCO KDN to quicken Korea’s energy digital transformation, scaling EMS, grid controls, and microgrid solutions across utilities & regional pilots.

- 2025: The Korean government introduced AI-driven microgrid pilots (Jeonnam and others) & Siemens has promoted digital microgrid & EMS solutions in Korea, supporting autonomous control & digital twin deployments.

What are the Key Highlights of the South Korea Microgrid Market (2026–34)?

- The South Korea Microgrid Market revenue is foreseen enhance with a market size of about USD 1.97 billion in 2025, and recording a strong CAGR of nearly 18.5% during 2026-34.

- Solar PV + ESS & CHP to dominate deployments, as well as grid-connected & hybrid microgrids flourish at fastest rate.

- KEPCO & policy (Renewable Energy 3020 Plan) accelerate projects and government subsidies.

- Investment outlook: solid technology trends, domestic ESS supply, and increasing industry partnerships.

How does the Future Outlook of the South Korea Microgrid Market (2034) Appears?

Through 2034, South Korea Microgrid Market is projected to be matured, with widespread Solar PV+ESS & CHP hybrids supplying resilient local grids. Also, market revenue & share reflect trmendous investment outlook as KEPCO-led pilots and government subsidies drive scale. Moreover, AI-enabled EMS & digital twins would optimize DERs, minimizing costs & unlocking new commercial services in the Microgrid Market in South Korea during the forecast years.

What Does Our South Korea Microgrid Market Research Study Entail?

- The South Korea Microgrid Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The South Korea Microgrid Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- South Korea Microgrid Market Overview

- Market Size, By Value (USD Billion)

- Market Share, By Power Source

- Natural Gas

- CHP (Combined Heat & Power)

- Solar PV-plus-ESS

- Diesel

- Fuel Cell

- Others

- Market Share, By Product Outlook

- Remote

- Grid Connected

- Hybrid

- Market Share, By Application

- Government

- Education

- Commercial

- Utility

- Defense

- Others

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- South Korea Natural Gas Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- South Korea CHP (Combined Heat & Power) Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- South Korea Solar PV-plus-ESS Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- South Korea Diesel Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- South Korea Fuel Cell Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- South Korea Others Microgrid Market Overview, 2026–2034

- By Value (USD Million)

- Competitive Outlook (Company Profiles)

- Viridien

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Northland Power Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Exelon Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- NRG Energy Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Spirit AeroSystems Holdings Inc Class A

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Eaton Corp PLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Honeywell International Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GE Aerospace

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ABB Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Viridien

- Contact Us & Disclaimer

List of Figure

-

Figure 1: Flowchart of Research Methodology

-

Figure 2: Breakdown of Primary Interviews (By Respondent Type, %)

-

Figure 3: Breakdown of Primary Interviews (By Designation, %)

-

Figure 4: South Korea Microgrid Market Snapshot (Market Size, Key Segments, Growth Rate)

-

Figure 5: South Korea Microgrid Market Size, By Value (USD Billion), 2025-2034

-

Figure 6: South Korea Microgrid Market Share, By Power Source (%), 2026 & 2034

-

Figure 7: South Korea Microgrid Market Share, By Product Outlook (%), 2026 & 2034

-

Figure 8: South Korea Microgrid Market Share, By Application (%), 2026 & 2034

-

Figure 9: South Korea Microgrid Market Share, By Company (Revenue Share, %), 2026

-

Figure 10: Market Dynamics Analysis: Key Drivers, Challenges, and Opportunities

-

Figure 11: Impact Analysis of Market Drivers

-

Figure 12: Impact Analysis of Market Challenges

-

Figure 13: Opportunity Assessment Framework

-

Figure 14: South Korea Natural Gas Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 15: South Korea CHP (Combined Heat & Power) Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 16: South Korea Solar PV-plus-ESS Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 17: South Korea Diesel Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 18: South Korea Fuel Cell Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 19: South Korea Other Power Source Microgrid Market Size, By Value (USD Million), 2026–2034

-

Figure 20: Competitive Dashboard, Key Players

-

Figure 21: Recent Developments Analysis (M&A, Partnerships, Product Launches)

List of Table

Table 1: Key Secondary Data Sources

Table 2: List of Companies/Primary Interview Respondents

Table 3: Key Primary Data Points Collected

Table 4: South Korea Microgrid Market Snapshot (Summary of Key Findings, 2026-2034)

Table 5: Market Dynamics - Detailed Driver Analysis

Table 6: Market Dynamics - Detailed Challenge/Restraint Analysis

Table 7: Recent Trends and Developments in the South Korea Microgrid Market (2025)

Table 8: Policy and Regulatory Framework Overview

Table 9: South Korea Microgrid Market Size, By Value (USD Billion), Forecast Years (2026–2034)

Table 10: South Korea Microgrid Market Share, By Power Source (%), Forecast Years (2026 & 2034)

Table 11: South Korea Microgrid Market Share, By Product Outlook (%), Forecast Years (2026 & 2034)

Table 12: South Korea Microgrid Market Share, By Application (%), Forecast Years (2026 & 2034)

Table 13: South Korea Microgrid Market Share, By Company (Revenue Share, %), 2026

Table 14: South Korea Natural Gas Microgrid Market Size, By Value (USD Million), 2026–2034

Table 15: South Korea CHP (Combined Heat & Power) Microgrid Market Size, By Value (USD Million), 2026–2034

Table 16: South Korea Solar PV-plus-ESS Microgrid Market Size, By Value (USD Million), 2026–2034

Table 17: South Korea Diesel Microgrid Market Size, By Value (USD Million), 2026–2034

Table 18: South Korea Fuel Cell Microgrid Market Size, By Value (USD Million), 2026–2034

Table 19: South Korea Other Power Sources Microgrid Market Size, By Value (USD Million), 2026–2034

Table 20: Competitive Landscape: Key Player Benchmarking

Table 21: Viridien: Company Overview

Table 22: Northland Power Inc.: Company Overview

Table 23: Exelon Corp.: Company Overview

Table 24: NRG Energy Inc.: Company Overview

Table 25: Spirit AeroSystems Holdings Inc. Class A: Company Overview

Table 26: Eaton Corp. PLC: Company Overview

Table 27: Honeywell International Inc.: Company Overview

Table 28: GE Aerospace: Company Overview

Table 29: Siemens AG: Company Overview

Table 30: ABB Ltd.: Company Overview

Top Key Players & Market Share Outlook

- Viridien

- Northland Power Inc

- Exelon Corp

- NRG Energy Inc

- Spirit AeroSystems Holdings Inc Class A

- Eaton Corp PLC

- Honeywell International Inc

- GE Aerospace

- Siemens AG

- ABB Ltd

- Others

Frequently Asked Questions