Understand The Key Trends Shaping This Market

Download Free SampleSouth Korea Green Hydrogen Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the South Korea Green Hydrogen Market?

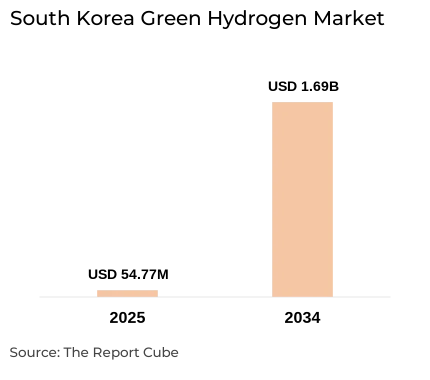

The South Korea Green Hydrogen Market is anticipated to register a CAGR of around 46.4% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 54.77 million in 2025 and is projected to reach nearly USD 1692.05 million by 2034.

Market Analysis & Insights

The South Korea Green Hydrogen Market growth is supported by large public-private projects (liquefied hydrogen carriers, regional hubs), strong government tenders for clean H₂-to-power, and corporate offtake pacts are augmenting demand & project pipelines. Also, the industry progression is concentrated in large-scale electrolysis, fuel-cell power generation, and transport refuelling networks. Further, future growth would rely on renewable electricity build-out & overseas hydrogen imports.

South Korea’s green hydrogen drive is commanded by national targets to scale hydrogen supply & commercial offtake, policies and tenders in 2024–25 stimulate project financing and technology deployment. For example: In May 2024, South Korea introduced the world’s first “clean hydrogen power” bidding market, aiming about 6,500 GWh of hydrogen-based electricity over 15-year contracts. Also, in 2025, the Ministry of Trade, Industry and Energy pledged approximately USD 360 million to create hydrogen industry clusters in Donghae & Pohang, anchoring storage, production, and distribution infrastructure.

Moreover, leading drivers include industrial decarbonization (steel, refining, chemicals), heavy transport fuel switching, and utility-scale green H₂ for power balancing. Along with this, technologies emphasis on Proton Exchange Membrane (PEM) & alkaline electrolysis together with onshore/offshore renewable generation & battery/hydrogen hybrid systems is also creating prospects for the market. Additionally, major market companies (global gas majors, electrolyzer OEMs, utilities) are building local partnerships & supply chains, for instance, industrial-gas contracts & hydrogen supply agreements with large Korean conglomerates developed distribution networks & generate demand points across the South Korea Green Hydrogen Market.

Furthermore, government-led tenders for H₂-to-power & programs for liquefied hydrogen carriers (2024–25) are unlocking scale economics & export/import options for the South Korea Green Hydrogen Market to flourish in the future years.

What is the Impact of AI in the South Korea Green Hydrogen Market?

Across the South Korea Green Hydrogen Market, AI is observed to enhance uptime & minimize the levelized cost of hydrogen by improving predictive maintenance, asset optimization, and electrolyzer performance forecasts. Also, machine learning (ML) expedites project siting & optimizes the dispatch of renewable energy sources to electrolyzers, advancing operational efficiency throughout the Green Hydrogen Market in South Korea.

South Korea Green Hydrogen Market Dynamics

What driving factor acts as a positive influencer for the South Korea Green Hydrogen Market?

- Policy Developments & Major Tender Activities to Enhance Market Share: South Korea’s trade, industry & energy ministry has run clean H₂-to-power tenders (2024–25) & backed liquefied hydrogen carrier programs, generating bankable revenue streams & augmenting supply chain investments. Hence, these tenders are levitating project IRR expectations & appealing global suppliers.

What are the challenges that affect the South Korea Green Hydrogen Market?

- Renewable-Power Availability & Cost: Without accelerating offshore/onshore renewables & infrastructure upgrades, Korea's limited land & grid constraints increase intermittent supply risk & elevate CAPEX per kg. Also, scaling green H₂ necessitates an abundance of inexpensive renewable electricity.

How are the future opportunities transforming the market during 2026-34?

- Industrial Clusters & Export Hubs: Regional projects (Jeonnam & other provinces bidding for big hydrogen complexes) generate cluster economics, incorporating production, storage, refuelling and export logistics that could decrease production expense & enable the South Korea Green Hydrogen Market linkages with other import markets across the global landscape.

What market trends are affecting the South Korea Green Hydrogen Market Outlook?

- Strategic Associations Between Global Energy Giants & Local Players: Multinational industrial-gas & energy companies are increasing Korea footprints through supply agreements & M&A, augmenting local distribution networks & technology transfer, Thus, this trend reduces time-to-market for big electrolyzer & liquefaction projects.

How is the South Korea Green Hydrogen Market Defined as per Segments?

The South Korea Green Hydrogen Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Technology: Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others.

- Application: Power Generation, Transport, Others.

By Technology:

Proton Exchange Membrane (PEM) electrolyzers dominated the South Korea Green Hydrogen Market by capturing the largest market share. The segment’s prominence is supported with the transport & flexible power applications owing to fast ramping & greater purity H₂, appealing for refuelling stations & fuel-cell power. Also, PEM employment is increasing where space, dynamic operation, and high-purity requires justify premium costs.

By Application:

Power generation (H₂-to-power) is the fastest-expanding application across the South Korea Green Hydrogen Market, accounting for the potential market share. As Korea targets clean baseload & grid balancing, government tenders precisely enabling H₂-power capacity are drawing project bids & investment, fueling utility-scale electrolyzers & fuel-cell park implementations ahead of wider transport rollouts.

South Korea Green Hydrogen Market: What Recent Innovations Are Affecting the Industry?

- 2025: Linde PLC declared expanded industrial-gas supply agreements with Samsung in South Korea, solidifying onshore distribution & enabling integrated hydrogen & gas solutions for huge industrial off-takers.

- 2025: Air Liquide shifted to deepen its South Korea footprint via a substantial acquisition path (DIG Airgas transaction activity in 2025), placing the company to scale industrial-gas & hydrogen services locally.

Key Highlights of the South Korea Green Hydrogen Market (2026–34)

- The South Korea Green Hydrogen Market is projected to expand at a CAGR of about 46.4% from mid-2020s to early 2030s.

- The market revenue size was valued about USD 54.77 million in 2025, and estimated to reach round USD 1692.05 million by 2034.

- Power generation (H₂-to-power) is forecast as the fastest expanding application segment over 2026–34.

- On technology side, PEM electrolyzers dominated in high-purity, dynamic duty use cases, while alkaline led large swift production.

How does the Future Outlook (2034) Appear?

Through 2034, the South Korea Green Hydrogen Market would probably scale swiftly (estimated CAGR 46.4% 2026–34), providing utility-scale electrolyzer capacity, prolonged refuelling networks, and export corridors. Moreover, broader green hydrogen acceptance would open industrial decarbonization & power-balancing market opportunities. Furthermore, AI-driven optimization & predictive maintenance would cut LCOH & accelerate employment across the South Korea Green Hydrogen Market by enhancing operational resilience nationally.

What Does Our South Korea Green Hydrogen Market Research Study Entail?

- The South Korea Green Hydrogen Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The South Korea Green Hydrogen Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

List of Figure

List of Table

Top Key Players & Market Share Outlook

- Air Liquide SA

- Air Products & Chemicals Inc

- Bloom Energy Corp Class A

- Cummins Inc

- Engie SA

- Linde PLC

- NEL ASA

- Siemens Energy AG ADR

- Uniper SE

- Others

Frequently Asked Questions