Understand The Key Trends Shaping This Market

Download Free SampleSouth Korea Gas Turbine Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the South Korea Gas Turbine Market?

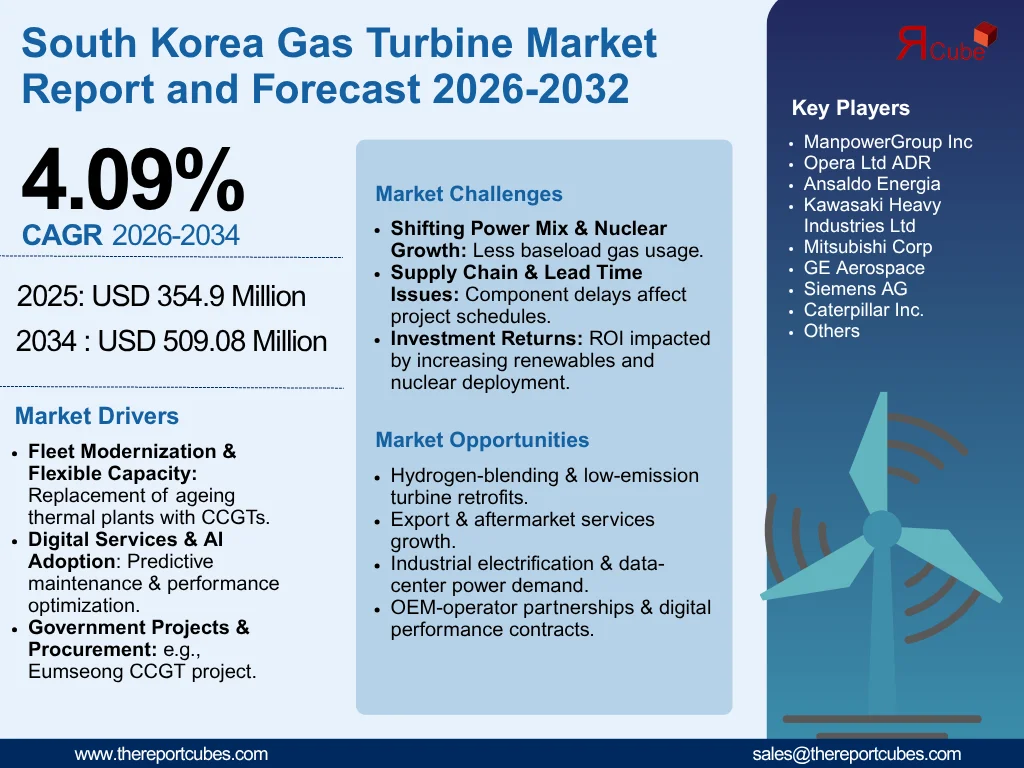

The South Korea Gas Turbine Market is anticipated to register a CAGR of around 4.09% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 354.9 million in 2025 and is projected to reach nearly USD 509.08 million by 2034.

Market Analysis & Insights

The South Korea Gas Turbine Market is being molded by electricity demand shifts, ageing thermal fleets, nuclear ramp-ups, and the increasing role of flexible gas plants for grid balancing. Also, utilities & independent power producers are trading older coal units with high-efficiency combined-cycle gas turbines (CCGTs) while manufacturers supply aeroderivative & heavy-duty units for power, marine and industrial usage. Further, development in data-center and industrial electrification to drive industry demand.

Moreover, government procurement & CCGT projects (e.g., Eumseong) are catalyzing orders for HL-class & comparable turbines, which is creating positive market outlook. Moreover, alloy/component lead times & supply-chain concerns have shortened delivery schedules, growing OEM margins & motivating conservative capacity surges. Also, large corporations (GE Aerospace, Siemens Energy, Mitsubishi/Kawasaki) are outspreading their naval/marine contracts & local alliances, as well as their after-sales service networks & spare parts distribution across Korea.

Additionally, growing adoption is augmenting owing to South Korea Gas Turbine Market innovation in digital performance services, hydrogen co-firing readiness, and low-emission turbines. Also, the advancement through hydrogen-ready technologies, AI-driven productivity, and sustainable modernization of power generation infrastructure, are foreseen to transform the South Korea Gas Turbine Market’s growth graph in the future years (2026-34).

What is the Impact of AI in the South Korea Gas Turbine Market?

AI & advanced analytics optimize turbine dispatch, predictive maintenance & fuel-mix management, elevating availability & reducing lifecycle expenses. Also, AI assists in accelerating remote condition monitoring & spare-parts planning, supporting quicker fleet turnarounds for utilities & marine operators, influencing competitiveness for gas turbine providers & operators alike.

South Korea Gas Turbine Market Dynamics

What driving factor acts as a positive influencer for the South Korea Gas Turbine Market?

- Fleet Modernization & Flexible Capacity to Drive Industry Growth: Replacement of ageing thermal plants with effective CCGTs & aeroderivative units to meet flexible-peaking requirements & data-center power demand that fuels OEM orders & service contracts. Also, recent CCGT project pipelines signal swift utility procurement, which eventually elevates the positive market growth.

What are the challenges that affect the South Korea Gas Turbine Market?

- Shifting Power Mix & Nuclear Growth: Large turbine application rates & return on investment are compressed by augmented nuclear generation & renewables, which also decreases baseload gas usage. Further, in 2024–2025, South Korea's nuclear revival minimized the import of fossil fuels & changed dispatch patterns, which negatively affected the South Korea Gas Turbine Market. Also, owing to this, turbines must offer larger flexibility & lesser minimum loads.

How are the future opportunities transforming the market during 2026-34?

- Hydrogen-Ready & Low-Emission Retrofits: OEMs providing hydrogen-blending capability, hybrid H₂ turbines, and retrofit packages could seizure conversion & repowering contracts as policy & fuel industries evolve, opening aftermarket & upgrade revenue streams for the national market.

What market trends are affecting the South Korea Gas Turbine Market Outlook?

- Digital Services & OEM-Operator Partnerships: The South Korea Gas Turbine Market is transforming as a result of digital performance monitoring, predictive analytics, and AI-based prognostics. Additionally, OEM revenues are shifting from one-time equipment sales to ongoing service & digital maintenance contracts, which is also enhancing this trend. Furthermore, increasing naval & industrial marine projects, such as the deployment of LM500 engines, are elevating market demand & strengthening projections for long-term market progression.

How is the South Korea Gas Turbine Market Defined as per Segments?

The South Korea Gas Turbine Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Design Type: Heavy Duty (Frame) Type & Aeroderivative Type

- Rated Capacity: Above 300 MW, 120-300 MW, 40-120 MW, and Less Than 40 MW

By Design Type:

The Heavy-duty (Frame) Turbines segment grabs the potential share of the South Korea Gas Turbine Market. The segment leads across the South Korea for utility & large CCGT plants owing to greater single-unit outputs & lifecycle economics. Also, combined-cycle projects utilizing heavy-duty units are often selected for grid-scale replacement of coal plants. Thus, these projects drive aftermarket spares & long-term service contracts. Moreover, the preference for frame machines is also strengthened by recent CCGT procurements & Siemens/other HL-class selections for Korean utility projects.

By Rated Capacity:

The 120–300 MW Gas Turbines segment to dominate the South Korea Gas Turbine Industry by capturing the favorable market share. Across the South Korea market, 120–300 MW gas turbines leads new combined-cycle (CCGT) installations, providing the ideal balance between operational flexibility & generation scale. Also, this capacity range supports grid steadiness, suits both repowering & merchant plants, and attracts solid OEM competition with long-term service agreements, further motivating consistent market demand & modernization across the 2026–2034 horizon.

South Korea Gas Turbine Market: What Recent Innovations Are Affecting the Industry?

- 2025: GE Aerospace awarded contract to supply eight additional LM500 marine gas turbine engines for the ROK Navy’s PKX-B Batch-II patrol boats, establishing marine propulsion presence across Korea.

- 2025: Kawasaki Heavy Industries began construction of a demonstration facility for a centrifugal hydrogen-related technology (hydrogen co-firing/demo efforts), signaling R&D momentum toward hydrogen-capable turbine systems.

What are the Key Highlights of the South Korea Gas Turbine Market (2026–34)?

- South Korea Gas Turbine Market is anticipated to expand swiftly, estimating about 4.09% CAGR through 2034.

- Combined cycle turbines lead owing to greater efficiency & lower emissions.

- Heavy-duty / utility scale segments dominate in revenue among service & equipment tiers.

- Export expansion in Korean turbine engines (nearly USD 600 million baseline) supports the global competitiveness.

- AI / Digitalization enables predictive maintenance, performance optimization, and asset management, minimizing downtime and O&M values.

How does the Future Outlook of the South Korea Gas Turbine Market (2034) Appears?

Through 2034, the South Korea Gas Turbine Market is probable to be far more cohesive, with hydrogen-blended & carbon-neutral turbines playing a central role. Developments such as Doosan Enerbility’s 380 MW H-class turbines, plus its export deal to supply the US plants, replicate the technological leap, creating profitable opportunities for the market. Moreover, South Korea would leverage AI-driven maintenance, digital twins, and long-term service contracts, solidifying both domestic deployment & export competitiveness.

What Does Our South Korea Gas Turbine Market Research Study Entail?

- The South Korea Gas Turbine Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The South Korea Gas Turbine Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- South Korea Gas Turbine Market Overview (2020–2034)

- Market Size, By Value (USD Million)

- Market Share, By Design Type

- Heavy Duty (Frame) Type

- Aeroderivative Type

- Market Share, By Rated Capacity

- Above 300 MW

- 120–300 MW

- 40–120 MW

- Less Than 40 MW

- Market Share, By Technology

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

- Market Share, By End User

- Power Generation

- Mobility

- Oil and Gas

- Others

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview (2020–2034)

- By Value (USD Million)

- By Design Type Market Overview (2020–2034)

- Heavy Duty (Frame) Type Market Overview (2020–2034)

- Aeroderivative Type Market Overview (2020–2034)

- By Rated Capacity Market Overview (2020–2034)

- Above 300 MW Market Overview (2020–2034)

- 120–300 MW Market Overview (2020–2034)

- 40–120 MW Market Overview (2020–2034)

- Less Than 40 MW Market Overview (2020–2034)

- By Technology Market Overview (2020–2034)

- Combined Cycle Gas Turbine Market Overview (2020–2034)

- Open Cycle Gas Turbine Market Overview (2020–2034)

- By End User Market Overview (2020–2034)

- Power Generation Market Overview (2020–2034)

- Mobility Market Overview (2020–2034)

- Oil and Gas Market Overview (2020–2034)

- Others Market Overview (2020–2034)

- Forecast Tables (2026–2034)

- South Korea Gas Turbine Market, By Value (USD Million), 2026–2034

- By Design Type, By Value (USD Million), 2026–2034

- By Rated Capacity, By Value (USD Million), 2026–2034

- By Technology, By Value (USD Million), 2026–2034

- By End User, By Value (USD Million), 2026–2034

- Competitive Outlook (Company Profiles)

- ManpowerGroup Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Opera Ltd ADR

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ansaldo Energia

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kawasaki Heavy Industries Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mitsubishi Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GE Aerospace

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Caterpillar Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- ManpowerGroup Inc

- Contact Us & Disclaimer

List of Figure

Figure 1.1 – Research Objective Overview

Figure 1.2 – Product Definition Framework

Figure 1.3 – Market Segmentation Breakdown

Figure 1.4 – Study Variables

Figure 2.1 – Secondary Data Sources Overview

Figure 2.2 – Companies Interviewed for Secondary Research

Figure 2.3 – Primary Data Collection Breakdown

Figure 2.4 – Primary Interviews by Stakeholder Type

Figure 4.1 – Key Market Drivers

Figure 4.2 – Market Challenges

Figure 4.3 – Opportunity Assessment

Figure 5.1 – Recent Trends and Developments in the Market

Figure 6.1 – Policy and Regulatory Landscape Overview

Figure 7.1 – South Korea Gas Turbine Market Size (2020–2034), USD Million

Figure 7.2 – Market Share by Design Type

Figure 7.2.1 – Heavy Duty (Frame) Type Market Share

Figure 7.2.2 – Aeroderivative Type Market Share

Figure 7.3 – Market Share by Rated Capacity

Figure 7.3.1 – Above 300 MW

Figure 7.3.2 – 120–300 MW

Figure 7.3.3 – 40–120 MW

Figure 7.3.4 – Less than 40 MW

Figure 7.4 – Market Share by Technology

Figure 7.4.1 – Combined Cycle Gas Turbine

Figure 7.4.2 – Open Cycle Gas Turbine

Figure 7.5 – Market Share by End User

Figure 7.5.1 – Power Generation

Figure 7.5.2 – Mobility

Figure 7.5.3 – Oil & Gas

Figure 7.5.4 – Others

Figure 7.6 – Market Share by Company

Figure 7.6.1 – Revenue Shares of Key Players

Figure 7.6.2 – Competition Characteristics

Figure 8.1 – Segment-wise Market Overview by Value (2020–2034)

Figure 8.2 – By Design Type Market Overview

Figure 8.2.1 – Heavy Duty (Frame) Type Market Overview

Figure 8.2.2 – Aeroderivative Type Market Overview

Figure 8.3 – By Rated Capacity Market Overview

Figure 8.3.1 – Above 300 MW Market Overview

Figure 8.3.2 – 120–300 MW Market Overview

Figure 8.3.3 – 40–120 MW Market Overview

Figure 8.3.4 – Less than 40 MW Market Overview

Figure 8.4 – By Technology Market Overview

Figure 8.4.1 – Combined Cycle Gas Turbine Market Overview

Figure 8.4.2 – Open Cycle Gas Turbine Market Overview

Figure 8.5 – By End User Market Overview

Figure 8.5.1 – Power Generation Market Overview

Figure 8.5.2 – Mobility Market Overview

Figure 8.5.3 – Oil & Gas Market Overview

Figure 8.5.4 – Others Market Overview

Figure 8.6 – Forecast Tables Overview (2026–2034)

Figure 8.6.1 – Market Forecast by Value (USD Million)

Figure 8.6.2 – Forecast by Design Type

Figure 8.6.3 – Forecast by Rated Capacity

Figure 8.6.4 – Forecast by Technology

Figure 8.6.5 – Forecast by End User

Figure 9.1 – ManpowerGroup Inc: Company Overview

Figure 9.2 – Opera Ltd ADR: Company Overview

Figure 9.3 – Ansaldo Energia: Company Overview

Figure 9.4 – Kawasaki Heavy Industries Ltd: Company Overview

Figure 9.5 – Mitsubishi Corp: Company Overview

Figure 9.6 – GE Aerospace: Company Overview

Figure 9.7 – Siemens AG: Company Overview

Figure 9.8 – Caterpillar Inc.: Company Overview

Figure 9.9 – Other Key Players

List of Table

Table 1.1 – Study Objectives Summary

Table 1.2 – Product Definition Details

Table 1.3 – Market Segmentation Overview

Table 1.4 – Study Variables

Table 2.1 – Secondary Data Sources

Table 2.2 – Companies Interviewed (Secondary Research)

Table 2.3 – Primary Interviews Breakdown

Table 2.4 – Primary Interviews by Stakeholder Type

Table 7.1 – South Korea Gas Turbine Market Size (2020–2034), USD Million

Table 7.2 – Market Share by Design Type (%)

Table 7.2.1 – Heavy Duty (Frame) Type Market Share (%)

Table 7.2.2 – Aeroderivative Type Market Share (%)

Table 7.3 – Market Share by Rated Capacity (%)

Table 7.3.1 – Above 300 MW

Table 7.3.2 – 120–300 MW

Table 7.3.3 – 40–120 MW

Table 7.3.4 – Less than 40 MW

Table 7.4 – Market Share by Technology (%)

Table 7.4.1 – Combined Cycle Gas Turbine

Table 7.4.2 – Open Cycle Gas Turbine

Table 7.5 – Market Share by End User (%)

Table 7.5.1 – Power Generation

Table 7.5.2 – Mobility

Table 7.5.3 – Oil & Gas

Table 7.5.4 – Others

Table 7.6 – Market Share by Company

Table 7.6.1 – Revenue Shares of Key Players

Table 7.6.2 – Competition Characteristics

Table 8.1 – Segment-wise Market Overview by Value (2020–2034)

Table 8.2 – By Design Type Market Overview

Table 8.2.1 – Heavy Duty (Frame) Type Market Overview

Table 8.2.2 – Aeroderivative Type Market Overview

Table 8.3 – By Rated Capacity Market Overview

Table 8.3.1 – Above 300 MW Market Overview

Table 8.3.2 – 120–300 MW Market Overview

Table 8.3.3 – 40–120 MW Market Overview

Table 8.3.4 – Less than 40 MW Market Overview

Table 8.4 – By Technology Market Overview

Table 8.4.1 – Combined Cycle Gas Turbine Market Overview

Table 8.4.2 – Open Cycle Gas Turbine Market Overview

Table 8.5 – By End User Market Overview

Table 8.5.1 – Power Generation Market Overview

Table 8.5.2 – Mobility Market Overview

Table 8.5.3 – Oil & Gas Market Overview

Table 8.5.4 – Others Market Overview

Table 8.6.1 – Market Forecast by Value (USD Million), 2026–2034

Table 8.6.2 – Forecast by Design Type (USD Million), 2026–2034

Table 8.6.3 – Forecast by Rated Capacity (USD Million), 2026–2034

Table 8.6.4 – Forecast by Technology (USD Million), 2026–2034

Table 8.6.5 – Forecast by End User (USD Million), 2026–2034

Table 9.1 – ManpowerGroup Inc: Key Financials and Business Segments

Table 9.2 – Opera Ltd ADR: Key Financials and Business Segments

Table 9.3 – Ansaldo Energia: Key Financials and Business Segments

Table 9.4 – Kawasaki Heavy Industries Ltd: Key Financials and Business Segments

Table 9.5 – Mitsubishi Corp: Key Financials and Business Segments

Table 9.6 – GE Aerospace: Key Financials and Business Segments

Table 9.7 – Siemens AG: Key Financials and Business Segments

Table 9.8 – Caterpillar Inc.: Key Financials and Business Segments

Table 9.9 – Other Key Players

Top Key Players & Market Share Outlook

- ManpowerGroup Inc

- Opera Ltd ADR

- Ansaldo Energia

- Kawasaki Heavy Industries Ltd

- Mitsubishi Corp

- GE Aerospace

- Siemens AG

- Caterpillar Inc.

- Others

Frequently Asked Questions